Singapore August 11 2022: The worst may be over for emerging Asian currencies as slower-than-expected US inflation eases pressure on the Federal Reserve to aggressively raise interest rates, according to DBS Group Holdings Ltd. and Malayan Banking Bhd.

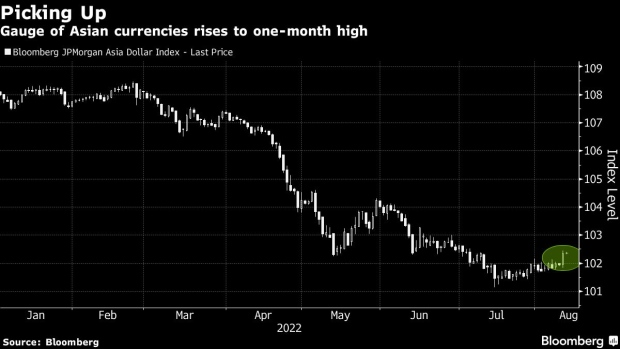

Currencies across the region jumped Thursday, following their developing-nation peers in the Americas and Europe, after the US data published Wednesday led to a slump in the dollar. The South Korean won and Thai baht both advanced 0.6%, and the Indonesian rupiah strengthened 0.5%.

“The US inflation data affirmed our assumption for the dollar to return gains against Asian currencies starting this quarter into the rest of the year,” said Philip Wee, a senior foreign-exchange strategist at DBS in Singapore. “The worst is likely over for Asian currencies, though volatility will persist.”

A weaker dollar will ease pressure on Asian central banks to raise borrowing costs and help support economic growth in the region amid the risk of a recession in the US and other developed nations.

Optimism toward emerging Asian assets has already been building in recent months as shown by fund inflows. This month alone, global investors have bought a net $2.06 billion of Indian stocks and $1.25 billion of Korean equities, along with $1.71 billion of Korean bonds and $721 million of Indonesian debt.

JPMorgan Asset Management shifted to an overweight position on Indonesian bonds this month, saying any selloff would be a good opportunity to buy duration.

‘Grind Lower’

The US consumer price gains slowed to 8.5% from a year earlier, down from a 9.1% June advance that was the largest in four decades, the Labor Department said Wednesday.

“Our baseline has always been for US inflation to grind lower over time, and for growth jitters to become more apparent into year-end,” said Yanxi Tan, a currency strategist at Maybank in Singapore. “That would support some retracement of the dollar’s strength against Asian FX in the second half of the year.”

Swaps referencing the Fed’s September meeting swung back toward a half-point rate increase after earlier pricing in a larger move.

“Bets on a 75 basis-point hike may be unwound, and the euro, the won and commodity currencies will get a boost as risk sentiment improves,” Kim Seunghyuk, a foreign-exchange analyst at NH Futures in Seoul, wrote in a research note.

Emerging Asia currencies are still nursing heavy losses this year. The Korean won has dropped 8.7%, the Philippine peso has fallen 8.1% and the Taiwan dollar has lost 7.6%.