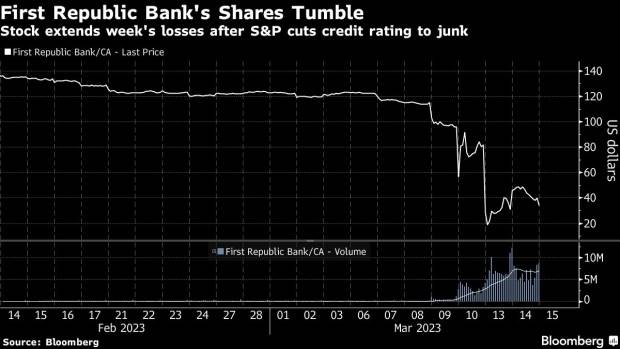

New York March 15 2023: First Republic Bank was cut to junk by S&P Global Ratings and Fitch Ratings amid concern that clients pull holdings from the lender, even after US regulators pledged support for the banking sector.

The California-based bank’s credit rating was lowered by S&P to BB+ from A- by, and it remains on credit watch negative, according to a statement Wednesday. Shortly after, Fitch cut the bank to BB from A-, a step below the S&P rating, and placed it on a negative rating watch.

Both credit assessors said further downgrades are possible as First Republic faces deposit outflows that could affect its liquidity profile and ramps up wholesale borrowing.

“The bank’s business position will suffer after the volatile swings in its stock price and heightened media attention surrounding deposit volatility,” S&P analysts Nicholas Wetzel and Rian Pressman wrote. “Its business stability has weakened as market perceptions of its creditworthiness have declined.”

Shares of First Republic slumped by as much as 26% Wednesday, with other regional banks also lower in another volatile day of trading. First Republic pared the drop to 17% at $33 per share, as of 12:07 p.m. in New York.

A spokesperson for First Republic Bank declined to comment on the rating cuts.

The downgrades from two major credit-rating companies officially move the bank to the high-yield market, a rare designation for financial institutions. Moody’s Investors Service placed the bank — along with five other lenders — on review for downgrade earlier in the week.

S&P expects the lender to ramp up wholesale funding in the aftermath of collapses at Silvergate Capital Corp., Silicon Valley Bank and Signature Bank. The move stands to hit both interest margin and profitability, the analysts wrote. Silicon Valley Bank’s rating was lowered and withdrawn by S&P after the lender was taken over by FDIC.

“First Republic’s total profitability is more weighted toward net interest income than most regional bank peers since its fee income (mostly fees related to wealth management) is less than 20% of total profit,” the S&P analysts wrote.

Fitch, meanwhile, said the bank’s positioning in municipal bonds and a deposit base being focused on “wealthy and financially sophisticated customers” also constrains the rating.

The lender’s “deposit concentrations are now viewed as a rating weakness,” Fitch analysts Johann Moller and Michael Shepherd wrote in a Wednesday statement.

In the wake of the collapse of SVB, US regulators put together an emergency package of support for financial institutions, designed to prevent any further failures.