Dhaka May 19 2023: Bangladesh could stop receiving petroleum products from some suppliers as the state-run Bangladesh Petroleum, the country’s primary oil importer, struggles to clear pending dues amid sharp currency devaluation, a BPC official told S&P Global Commodity Insights.

Most of the oil suppliers have written to Bangladesh Petroleum to clear the pending dues, BPC’s director for operations and planning Khalid Ahmed said, adding that some of the entities have even warned of stopping oil supply to Bangladesh if the dues were not cleared “immediately.”

Ahmed did not name the companies.

Bangladesh Petroleum owes around $297.49 million to different refined fuel product suppliers as of May 16, a senior BPC official told S&P Global on conditions of anonymity, as he was not authorized to speak to the media.

Over the past several months, although BPC has paid around one-third to half of the total pending dues to some of the oil suppliers after missing payment deadlines, the state-run agency has also “failed to pay any single penny to some other suppliers,” the official said.

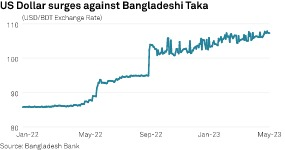

The state companies have been hit by falling foreign exchange reserves, with the Bangladeshi Taka currently trading near record lows against the US dollar and arrears to several companies piling up.

“We didn’t face such type of a situation over payments in the past … We could always clear payments within deadlines [earlier],” Ahmed said, acknowledging that BPC was now struggling to pay dues to foreign suppliers in US dollars, a situation also being faced by some other state energy firms in the South Asian country.

The state-run oil importer was clearing payments within eight to 10 days over the 30-day deadline for oil loading by suppliers until the end of February, but from March onward BPC has not been able to clear full dues to any of the suppliers, according to sources.

BPC, which purchases oil from the international market in US dollars and sells to end-users in local currency, typically has very little in hand if it does not get US dollars from the commercial banks for making payments, Ahmed said.

“We have talked over the issue with the governor of the central bank to arrange US dollars for making payments to the suppliers,” said the top BPC official. “But we are yet to get any remedy.”

Fuel oil import outlook bleak

Bangladesh Petroleum usually floats tenders twice every calendar year to import its refined oil products during January to June and July to December periods and also enters negotiation with selected suppliers twice to fix the fuel prices.

However, now BPC fears having higher price quotes from oil suppliers for future purchases if the dues are not cleared soon, Ahmed told S&P Global.

“Currently, private-sector [power plant] owners are also not getting sufficient US dollars from the central bank to import HSFO,” the president of Bangladesh Independent Power Producers’ Association, or BIPPA, Faisal Khan told S&P Global May 17.

He said the government ceased paying dues to many private power plants since September 2022 and currently the BPDB owes around Taka 180 billion (around $1.80 billion) to private power plant owners — an amount equivalent to six months’ dues, Khan said.

Bangladesh is likely to import around 350,000 mt of high sulfur fuel oil in May, down about 12.5% compared with April, S&P Global reported earlier.

The Asian high sulfur fuel oil market usually tends to see a seasonal uptick in demand from South Asian countries such as Bangladesh, Sri Lanka and Pakistan for higher power generation demand during the summer months, but traders said it has been much lesser than expected so far this year.

Pakistan, which typically used to be a net importer of fuel oil, has turned out to be an exporter in recent months and has added to the regional supplies, weighing on the Asian HSFO market fundamentals, trade sources said.

The benchmark Singapore 380 CST high sulfur fuel oil cash differential to MOPS 380 CST HSFO assessments, which has plunged more than 35% since the start of April, was assessed at a premium of $5.25/mt May 17, S&P Global data showed.

South Korean supply

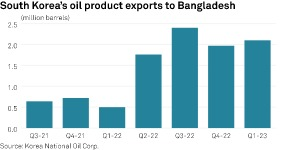

Asia’s top middle distillate exporter and supplier South Korea has been ramping up oil product sales to Bangladesh in recent months, with the first quarter shipments to the South Asian nation, mostly diesel, surging to 2.1 million barrels from just 500,000 barrels a year earlier, latest data from Korea National Oil Corp. showed.

When asked about any delay in payments for oil product sales to Bangladesh, major South Korean fuel exporters, including S-Oil and SK Energy, declined to comment due to the sensitive nature of international corporate business relationships.

A middle distillate marketing manager at a major South Korean refiner based in Seoul told S&P Global that sales to South Asian countries with low foreign exchange reserves and weak currencies are considered “high-risk business.”