Islamabad May 25 2023: Pakistan expects China to roll over more than $2bn in debt due next month, but is still bracing itself for other repayment deadlines that risk tipping the country into default.

With a crucial IMF lending programme stalled, Pakistan has about $3.7bn in overseas debt due this month and in June against its current foreign reserves of just $4.3bn.

Two senior Pakistani officials said Beijing had committed to help the country meet two crucial debt repayments in June worth a total $2.3bn by providing fresh funds immediately after Pakistan makes the payments. The refinancing of the commercial loans worth $1.3bn and a Chinese government loan of $1bn would help Pakistan avert immediate default, the Pakistani officials said.

The Chinese government did not respond to a request for comment, but Beijing earlier this year already rolled over some loans to Pakistan. Chinese foreign minister Qin Gang also reiterated Beijing’s financial support for the country on a visit to Pakistan earlier this month.

Several analysts said they expected the relief from China — one of Pakistan’s closest allies — to come through, but warned it would not remove the risk of default.

“There’s no way that the Chinese . . . will walk back from Pakistan at this time,” said Uzair Younus, director of the Pakistan Initiative at the Atlantic Council, a Washington-based think-tank, referring to the June debt deadlines.

But Younus added that a severe shortage of external financing had resulted in “economic shock going through the entire society”.

Pakistan, which has long relied on lenders such as the IMF and China to finance its budget deficits, is trapped in one of the worst economic crises in its history.

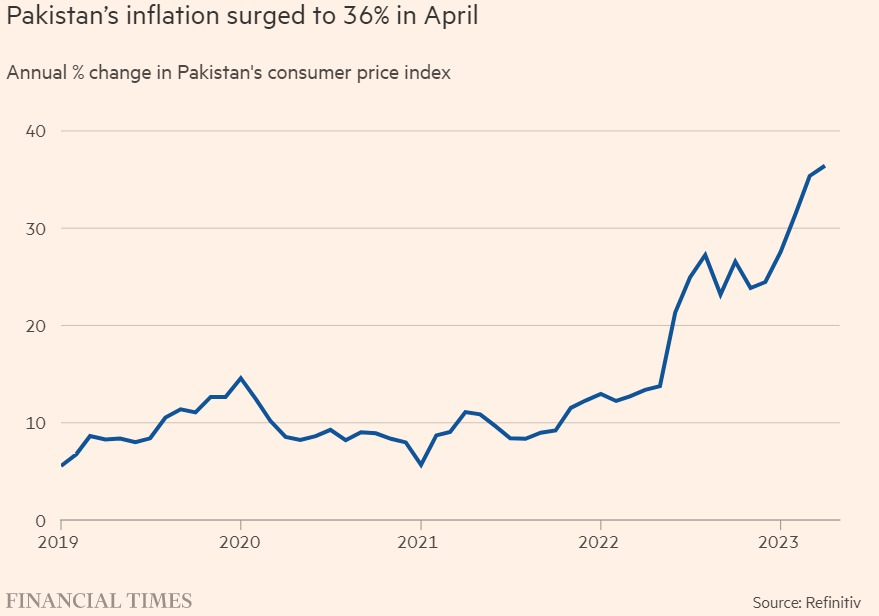

The collapse in foreign reserves, now only enough to finance about a month of imports, has led to severe import shortages. Record-high consumer price inflation — which hit 36 per cent in April — has eroded living standards and exacerbated poverty in the country of more than 220mn people.

Central bank data shows Pakistan’s foreign debt has roughly doubled since 2015 to more than $120bn. The increase has been fuelled by rising commodity import bills, borrowing for projects including those that are part of China’s Belt and Road infrastructure initiative, and the fallout of the Covid-19 pandemic.

The Pakistani officials said they expected to receive up to $400mn from foreign donors following pledges to finance recovery from devastating floods last year.

But the country has for months been unable to resume a stalled $7bn IMF programme that many analysts say is a crucial first step to turning its economic situation around. Pakistan revised its growth forecast for 2023 on Thursday to just 0.29 per cent, down from 2 per cent and trailing the IMF estimate of 0.5 per cent.

Prime Minister Shehbaz Sharif’s government has fiercely resisted some of the measures the IMF has demanded, such as tax increases and subsidy cuts. While it eventually agreed to some conditions, officials and analysts said the two sides had also clashed over how Pakistan should build up its foreign reserves.

But many analysts say an IMF deal is crucial to restore investor confidence and would help unlock further financing from other international partners such as Saudi Arabia or the United Arab Emirates.

They add that, with officials estimating that Pakistan needs to repay about $25bn in debt in the financial year that starts in July, the country will probably require further borrowing and potentially a new IMF programme if it is to stave off default.

“The situation is extremely delicate. We are at the worst financial position in our history [in terms] of sustainability of balance of payments,” said Hafiz Pasha, a former finance minister. “This time we will need an extended arrangement with the IMF for restructuring and reprofiling of our debt.”

Yet Pakistan’s political crisis risks throttling any chance of an economic turnround. Sharif’s government, with the backing of the country’s powerful military, is locked in a stand-off with former prime minister Imran Khan.

Analysts consider Khan the most popular candidate ahead of national elections due by October. The former prime minister is on bail after being arrested this month on what he calls trumped-up corruption charges. Authorities launched a crackdown on Khan’s Pakistan Tehreek-e-Insaf party after violent protests by his supporters while he was in custody.

Foreign officials have warned the political volatility risks distracting Pakistan from resolving its economic problems. While in Islamabad, China’s Qin called on Pakistani politicians to “uphold stability . . . so that [they] can focus on growing the economy”.

“Political stability is the prerequisite to overall stability. The optimistic scenario is Pakistan getting political stability in the next three months,” said Ali Farid Khwaja, head of Karachi-based brokerage KTrade Securities. “If they cannot deliver on political stability, then a default scenario looks more likely.”

Miftah Ismail, another former finance minister, said deep economic reform would also be needed.

“Pakistan’s viability at this point depends on magnanimity of its friends,” he said. “Radical solutions have to be adopted to widen the tax net and reduce expenditure to impress the outside world.”