Karachi September 19 2023: Pakistan banking sector profitability increased 125 percent to PKR 284.5 billion in H1CY23 despite challenging economic environment, according to State Bank of Pakistan Mid-Year performance review.

Profitability indicators of banking sector improved in H1CY23. The after-tax ROA rose to 1.5 percent (0.8 percent in H1CY22 and 1.0 percent in CY22) while ROE enhanced to 26.0 percent from 12.9 percent in corresponding period of last year.

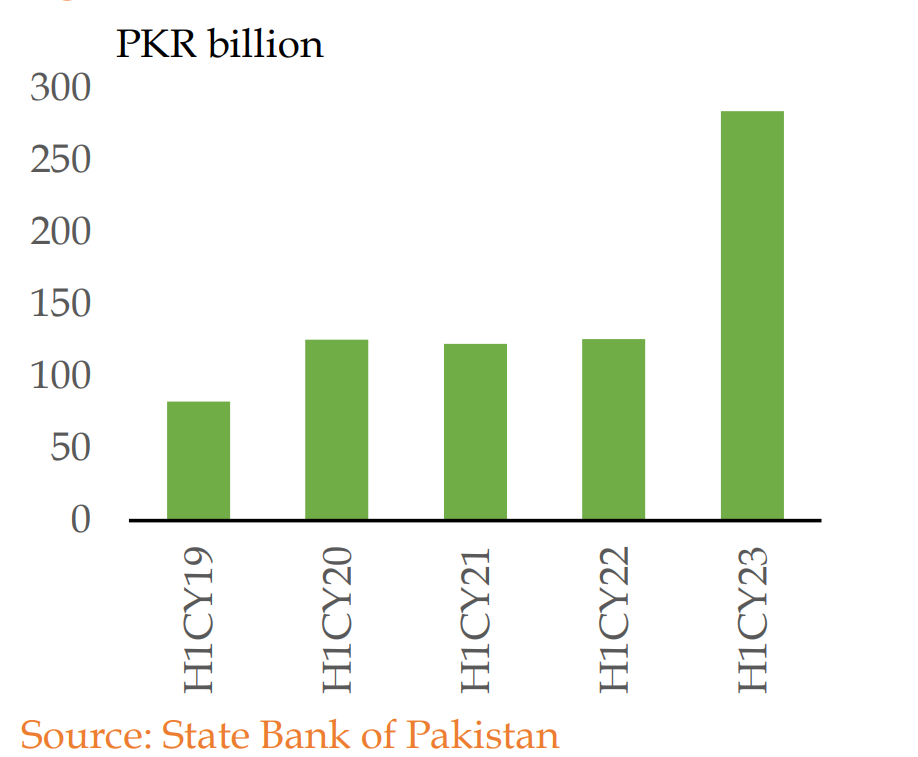

Trend in Profitability Indicators

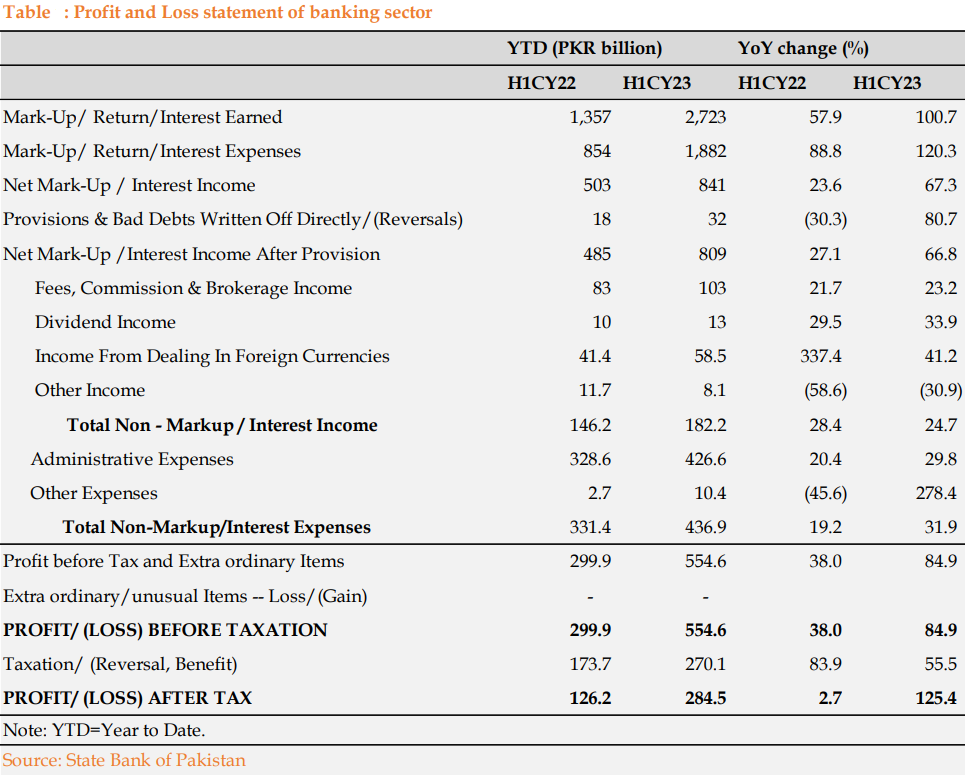

The major push to earnings came from higher net interest income, as the rising interest rates translated to higher earnings while noninterest income also augmented the bottom line during the reviewed period. On expenses side, provisioning was relatively higher in H1CY23 and operating expenses also recorded sharp growth due to branch expansion as well as elevated inflation. Nonetheless, the after-tax profit more than doubled to PKR 284.5 billion in H1CY23 when compared to PKR 126.2 billion in H1CY22.

Banking sector Profit After Tax (PAT)

Detailed analysis shows that net interest income grew (NII) by 67.3 percent in H1CY23 compared to 23.6 percent increase in same period last year (Figure 15), as the policy rate was raised a number of times during the period under review while earning assets also posted steady growth. 13 Though interest income doubled to PKR 2,723.1 billion in H1CY23 as compared to H1 last year, interest expenses more than doubled to PKR 1,882.1 billion, offsetting a significant part of the growth in interest income – as the funding side is repriced relatively earlier than earning assets.

The analysis of sources of growth in interest income reveals that the major increase in income on advances and investments was due to rise in interest rate while the expansion in volume of these assets also contributed in the growth of interest income.

A similar effect was also visible in interest expenses on deposits and borrowings, however, the impact of increased volume of borrowing was relatively significant, as reliance on borrowing increased to finance accelerated expansion in asset base over the period.

In line with the rising share of investments in banks’ balance sheet, interest income from investments rose to 62.0 percent of total interest earnings.

On the expense side, interest on deposits contributed around 60 percent of total interest expenses, however, the share of repo-based borrowing also shows a noticeable increase over the last couple of years.

Growth in non-interest income decelerated to 24.7 percent in H1CY23 (28.4 percent in H1CY22). Though higher income from fee, commission and brokerage and dealing in foreign exchange supported non-interest income, the trading losses on sale of securities offset a part of the non-interest income. A major part of the trading losses comprised losses on sale of shares.

Provisioning expenses were higher at PKR 31.6 billion in H1CY23 compared to PKR 17.5 billion in same period last year as banks set aside higher loan loss reserves to improve the provision coverage of delinquent loan portfolio.

Non-interest expenses recorded noticeable increase of 31.9 percent in H1CY23, which was higher than last year. Apart from branch expansion and rise in human resources, higher inflation explains the increase in admin expenses.