Karachi September 27 2023: Engro Corporation Limited (ENGRO) to restructure its thermal energy assets under a separate wholly owned holding company to optimize resource allocation, according to company filing to the exchange.

The Board of Engro Corporation Limited (the “Company”) has authorized the Company for the restructuring and / or reorganization of its thermal energy assets under a separate wholly owned holding Company, as part of its ongoing efforts to streamline and optimize capital and resource allocation.

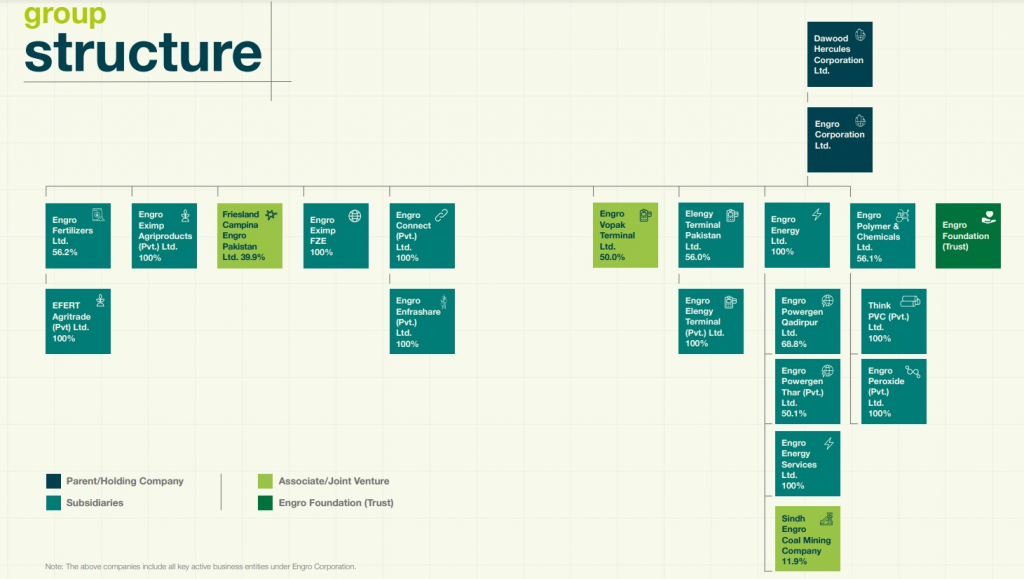

Incorporated in 2008 as a fully owned subsidiary to develop power projects in Pakistan. Engro Energy Limited owns and operates Engro Energy Qadirpur Limited, a 217 MW combined cycle power plant and the first green facility in Pakistan to utilize permeate gas for reduced carbon emissions.

Moving further in its efforts to improve energy efficiency and ecosystem in the country, Engro Energy formed the Sindh Engro Coal Mining Company in collaboration with its partners to unearth and mine one of the world’s largest lignite coal reserves in Thar – achieving a first for the country in terms of becoming one of the only private sector entity with the engineering capability, capacity and expertise to operate and optimize an open-pit mine. Soon thereafter, the Company ventured into establishment of 2×330 MW mine-mouth power plants in Tharparkar through a dedicated subsidiary, Engro Powergen Thar Private Limited. The culmination of these Thar coal projects from inception to financial close and including the stellar project management, which remains inclusive and collaborative, is testament to our organizational knowledge and skill in delivering projects of significant magnitude and strategic importance.

Last year Engro Energy, in collaboration with the Government of Sindh, is currently evaluating the development of Pakistan’s first hybrid 1 GW renewable energy (RE) park. The project has potential to provide ~ USD 400 million in import substitution. Phase I of the project, with a

capacity of 400 MW, is planned to be operational by early 2024, with confirmed land availability. This initiative aims to reduce electricity costs for industrial consumers by approximately 20% and support the Government’s goal of increasing the share of renewable energy in Pakistan’s energy mix to 30% by 2030. The Company has also been successful in securing interest from buyers, as evidenced by the ~670 MW worth of MOUs that have been signed. At the same time, it is working with policymakers to build a landscape conducive to project execution.