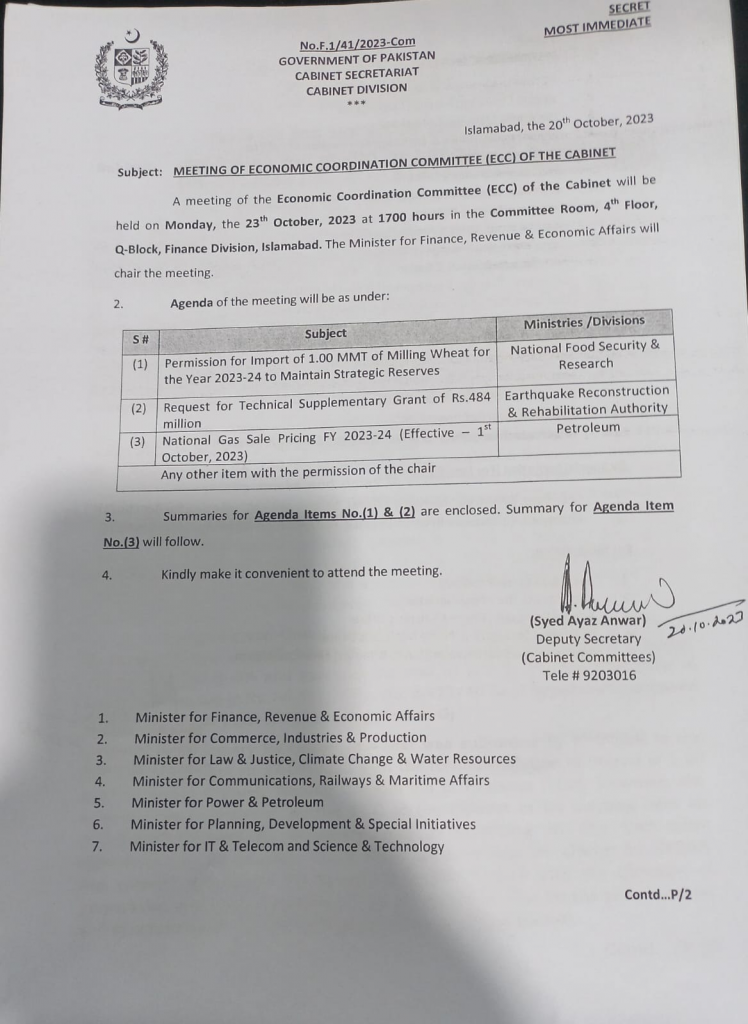

Islamabad October 23 2023: A meeting of the Economic Coordination Committee (ECC) of the cabinet will be held on today, Monday at 17:00 to take up increase in gas prices effective from October 1st 2023.

ECC will also take up import of wheat of 1.0 MMT for the year 2023-24 to maintain strategic reserves and technical supplementary grant of PKR 484 million for Earthquake Reconstruction & Rehabilitation Authority.

To prevent an increase in the gas circular debt for the fiscal year 2023-24, the approach will involve raising local gas tariffs substantially. This entails a 173% increase for non-protected domestic consumers, a 136.4% increase for commercial users, an 86.4% increase for exports, and a 117% increase for non-export industries. No budgeted subsidies are allocated for domestic, commercial, or industrial sectors, meaning that high-end consumers will effectively subsidize low-end consumers.

However, the failure to implement gas price increases from July 1 has resulted in a loss of Rs50 billion in the gas sector during the July-September period. Historically, the feed gas price for the fertilizer sector has been kept low to maintain affordable urea prices for farmers. Proposed prices for feed and fuel for fertilizer plants on both the MPCL and Sui networks are Rs580/MMBtu and Rs1,580 per MMbtu, respectively.

Conversely, the cement sector is poised to experience a substantial gas tariff increase of 193.3% to Rs4,400 per MMBtu from the existing Rs1,500 per MMBtu. The CNG sector will also see a significant rise, by 143.8% to Rs4,400 from Rs1,805 per MMBtu. This will result in higher cement prices and more expensive CNG than petrol, potentially affecting the CNG industry. Gas tariffs for roti tandoor, however, remain unchanged.

Another proposal involves supplying a blend of local gas and RLNG to the power sector to reduce power tariffs. This proposal is under consideration, but gas companies currently lack the capacity to provide local gas to RLNG-based power plants.

A detailed summary by the petroleum ministry, presented in an ECC meeting, suggests that the 4 protected domestic consumer categories will not have their gas tariffs increased, but their monthly fixed charges will rise significantly. The first 4 non-protected domestic consumers will see their monthly fixed charges increase by 117.4% to Rs1,000 from Rs460 per month, accompanied by gas tariff increases of 50-150%. The remaining 4 non-protected domestic consumers will experience a 334.78% increase in monthly fixed charges, raising them to Rs2,000 from Rs460 per month, along with gas tariff hikes of 100-173%.

The summary also addresses the use of a blend of natural gas (NG) and RLNG for non-export industries. SNGPL will offer a blend of 20% NG and 80% RLNG, subject to quarterly review based on gas availability. SSGC, on the other hand, will provide a blend of 90% NG and 10% RLNG for industrial consumers, with similar quarterly reviews.

The state-owned gas companies appear to be retaining control over non-export industries, potentially limiting opportunities for the private sector to engage in RLNG business. This could discourage the establishment of future RLNG terminals under the Business to Business model, as they may not be able to compete with gas companies offering a blend of local and imported gas at more competitive rates.