FRANKFURT, February 1 2024 : Deutsche Bank (DBKGn.DE), opens new tab said on Thursday it would cut 3,500 jobs, buy back shares and pay dividends, in its latest pitch to investors that its turnaround remains on track.

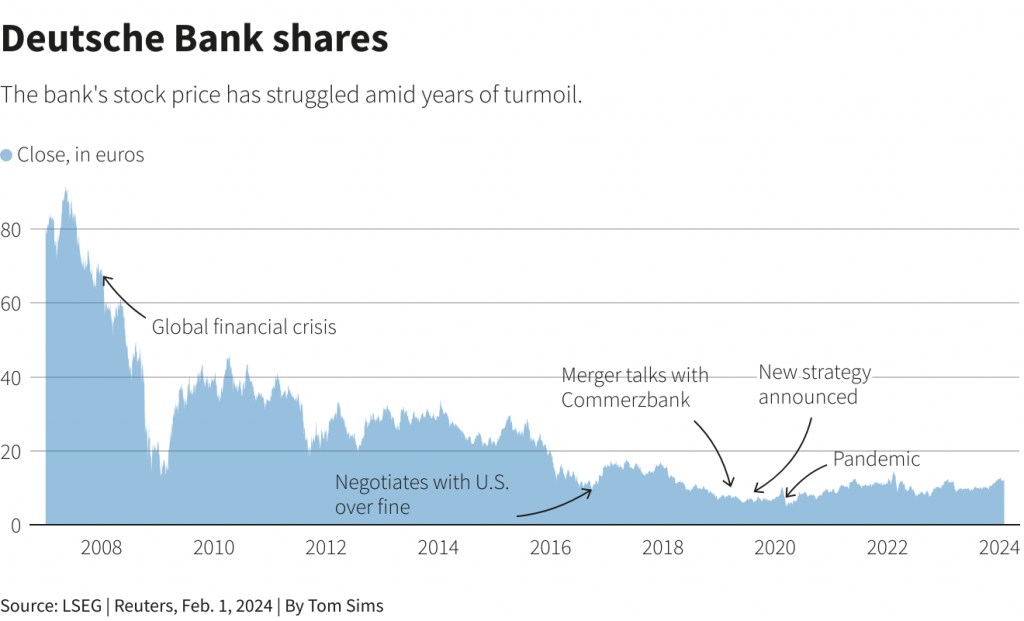

The news came as Germany’s biggest bank, seeking to put years of turmoil behind it and focus on steadier retail banking, reported a 30% drop in fourth-quarter profit that still beat analyst expectations.

The bank had already announced plans to cut jobs, but this was the first time it had put a number on the layoffs, equivalent to just under 4% of its global workforce of about 90,000. The jobs affected will be back office roles.

The share buyback and dividends will total 1.6 billion euros ($1.7 billion) and will take place during the first half of the year. The bank also raised its forecast for revenue growth, and its shares rose 4% in early Frankfurt trade.

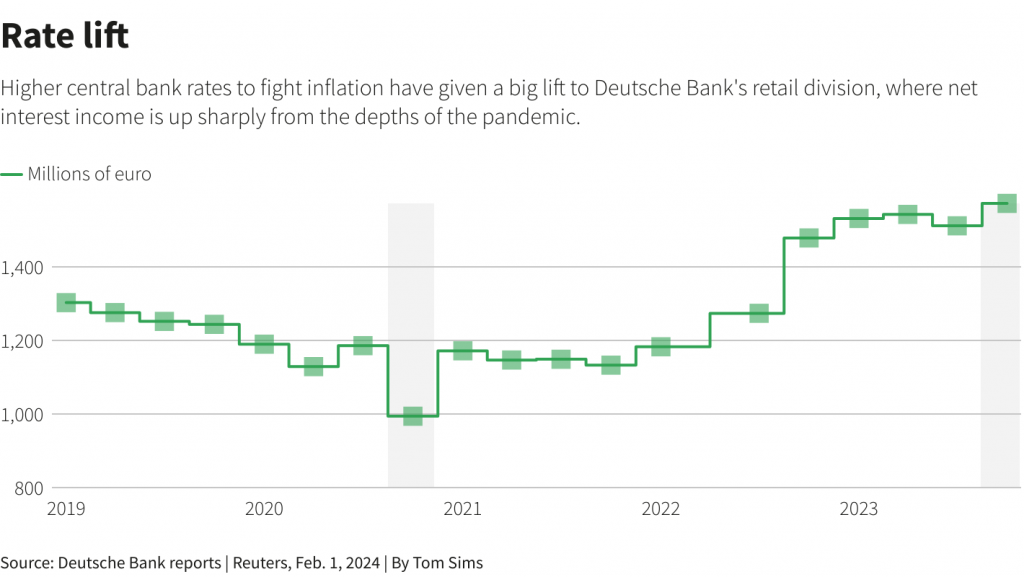

The announcements and earnings come at a significant turning point for Deutsche Bank. Deutsche Bank’s retail unit overtook the investment bank as the main revenue driver in 2023, overturning the latter’s pole position over the previous three years as the retail division benefited from higher interest rates and global deals fizzled.

Analysts expect the retail operations to keep up its streak ahead of the investment bank this year and next even as central banks gear up to cut the interest rates that have supercharged banks’ bottom lines.

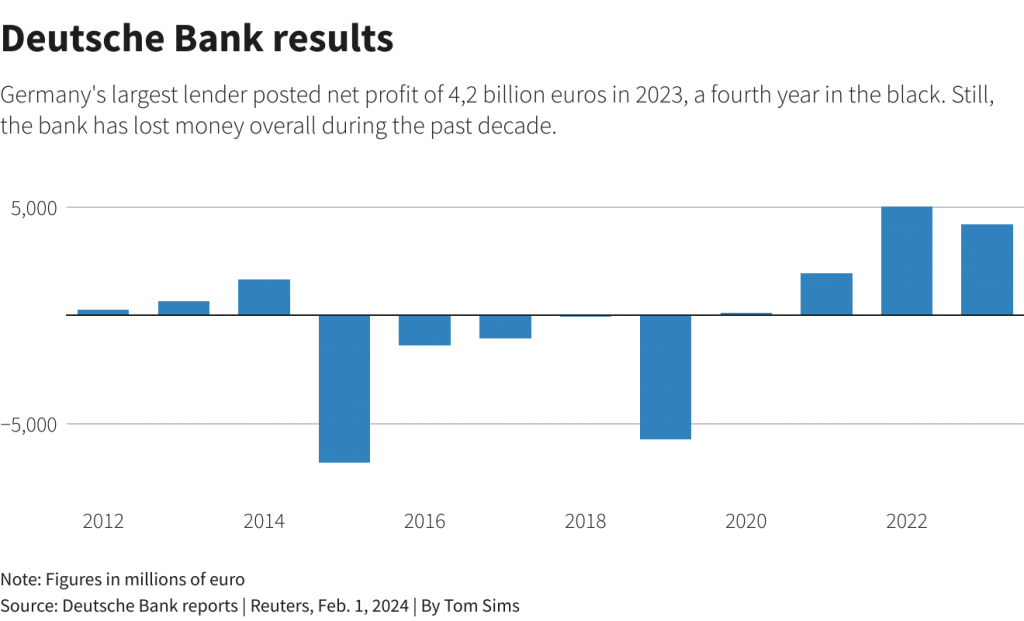

Deutsche Bank, which undertook a major overhaul in 2019 after years of losses, has tried to wean itself off from its dependence on the volatile investment bank for revenues, something that proved difficult.

The ascendance of the retail division has come as it has drawn the scorn of regulators after it botched the integration of its Postbank arm, leaving customers complaining that they were locked out of their accounts and unable to reach call centres.

The troubled integration has highlighted the challenges of a tie-up with another bank. Several weeks ago, merger speculation involving Deutsche gained traction but the bank moved to douse the talk.

The drop in quarterly profit came as restructuring costs and other one-off expenses outweighed revenue gains, but the fall was not as steep as analysts feared.

Net profit attributable to shareholders was 1.26 billion euros in the quarter. That compares with profit of 1.803 billion euros a year earlier and is better than analyst expectations for profit of around 700 million euros.

Full-year profit fell to 4.21 billion euros from 5.03 billion euros a year earlier, beating analyst expectations for 3.664 billion.

The drop in quarterly profit was the largest since earnings at Germany’s biggest bank stabilised earlier in the decade after years of losses. But the figures nevertheless mark the 14th consecutive quarter and the fourth consecutive year of profits – notable streaks in the black for Deutsche. The earnings set the stage for what could be a more difficult 2024 for banks, with possible interest rate cuts later this year eroding the interest income that has proven a boon to banks in recent quarters.

That has helped German lenders ride out a weak economy at home, with the nation’s output shrinking last year and a closely watched survey of business morale in January unexpectedly worsening. Germany’s financial regulator BaFin warned recently that 2024 will be less rosy for bank profits as a property crisis weighs in Europe’s largest economy and loans go bad. Still, Deutsche was optimistic, raising its compounded annual growth rate target for revenues to between 5.5% and 6.5%, up from between 3.5% to 4.5%.

Deutsche CEO Christian Sewing said he had “firm confidence” the bank could meet its 2025 targets but he was prepared for “a continued bumpy economic ride”.

Investment banking revenue rose 10% during the quarter, lagging an expected 17% rise. A 9% increase in revenues at the corporate bank beat expectations of a 5% gain, and the retail division’s 4% fall beat expectations of a 6% drop.

Revenue for fixed-income and currency trading, one of the bank’s largest businesses, rose 1% versus expectations for a 7.5% rise. That is better than some competitors, like Goldman Sachs.

($1 = 0.9260 euros)