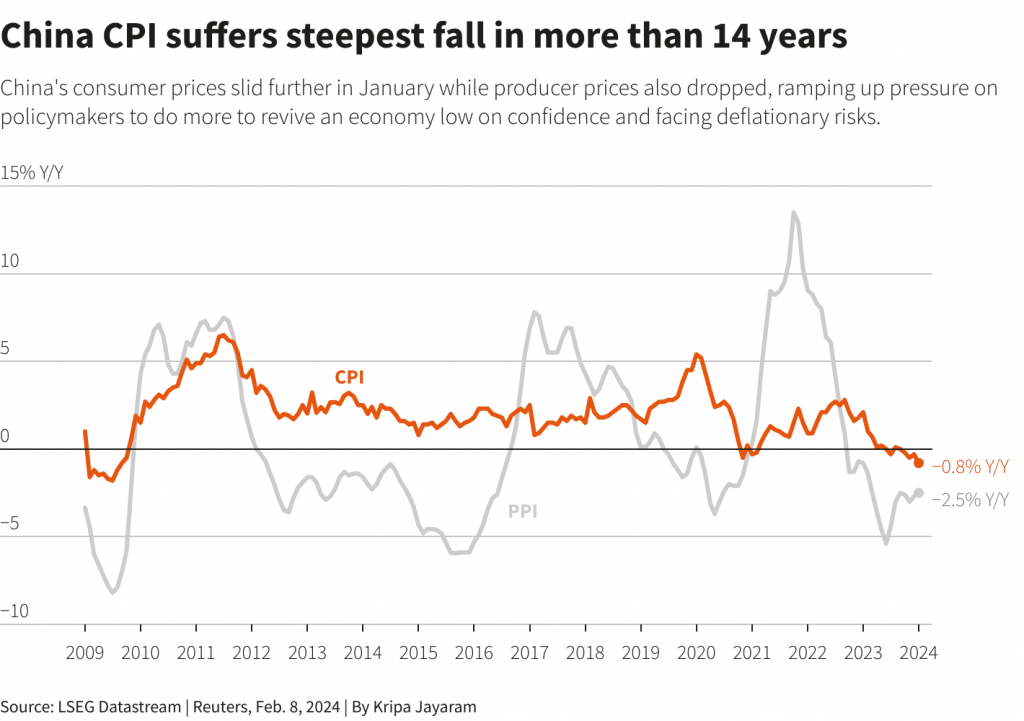

Beijing February 8 2024: China’s consumer prices fell at their steepest pace in more than 14 years in January while producer prices also dropped, ramping up pressure on policymakers to do more to revive an economy low on confidence and facing deflationary risks.

The world’s second-biggest economy has been grappling with slowing prices since early last year, forcing policymakers to cut interest rates to spur growth even as many developed economies were focused on taming stubbornly high inflation.

The consumer price index (CPI) fell 0.8% in January from a year earlier, after a 0.3% drop in December, data from the National Bureau of Statistics (NBS) showed on Thursday. The CPI rose 0.3% month-on-month from a 0.1% uptick the previous month.

Economists polled by Reuters had forecast a 0.5% fall year-on-year and a 0.4% gain month-on-month.

The annual CPI decline in January was the biggest since September 2009, mainly led by a sharp drop in food prices, but analysts warn the overall deflationary impulse in the economy risks becoming entrenched in consumer behaviour.

“The CPI data today shows China faces persistent deflationary pressure,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management.

“China needs to take actions quickly and aggressively to avoid the risk of deflationary expectation to be entrenched among consumers.”

The Asian giant has struggled to regain economic momentum since the end of COVID curbs in late 2022, and nervous investors have dumped Chinese stocks amid a deepening property crisis and local government debt risks.

Global demand has also remained relatively soft, with an official survey showing activity in China’s vast manufacturing sector contracting in January.

Chinese stocks retreated shortly after the weak CPI data before rebounding again, helped by the recent rapid-fire support measures.

ENTRENCHED DEFLATION?

The economy grew 5.2% in 2023, meeting the official target of around 5%, but the recovery has been much shakier than investors had expected. Policy insiders expect Beijing to maintain a growth target similar to last year of around 5%.

China’s central bank in late January announced the deepest cut to bank reserves in two years, sending a strong signal of support for the fragile economy but analysts say policymakers need to do more to lift confidence and demand.

Core inflation, which strips out volatile food and energy prices, gained 0.4% from a year earlier, down from a 0.6% gain in December.

CPI rose 0.2% last year, missing the official target of around 3%, the 12th straight year that inflation had undershot annual targets.

“Deflation/Disinflation is becoming entrenched,” said Carlos Casanova, senior Asia economist at Union Bancaire Privee in Hong Kong, in a note to clients.

“The decline is testament to weak domestic consumption. We think a massive stock market sell-off is partially to blame for the decline in sentiment and associated consumption,” Casanova added.

The data also pointed to persistent factory gate deflation, keeping the pressure on manufacturers as they try to recover lost business.

The producer price index (PPI) slid 2.5% from a year earlier in January after a 2.7% fall the previous month, compared with a 2.6% slide forecast in the Reuters poll.

Factory-gate prices were down 0.2% from a month earlier, after falling 0.3% in December.

Prolonged factory deflation is threatening the survival of smaller Chinese exporters who are locked in relentless price wars for shrinking business.

“The People’s Bank of China really ought to deliver stronger policy support,” Union Bancaire Privee’s Casanova said.

“We would prefer to see broad-based interest rate cuts in February, but that remains unlikely given the lack of policy space and issues in policy transmission.”