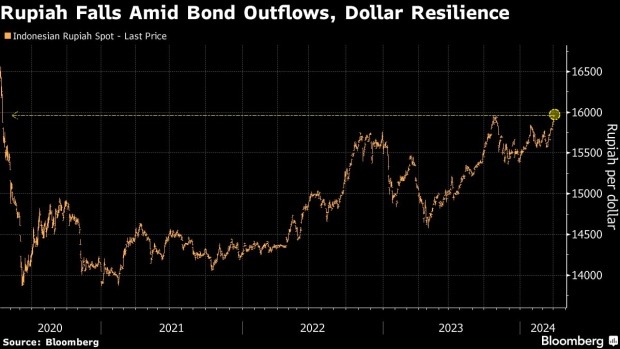

Jakarta April 2 2024: The Indonesian rupiah fell to a four-year low amid a broad dollar rebound and as foreign funds continued to sell local bonds on worries over the incoming administration’s pledges to boost spending.

The currency slipped about 0.5% against the greenback to 15,963 on Tuesday, the lowest since April 2020. Global funds withdrew some $1.7 billion from Indonesian bonds in the first quarter, the most since the three-months through September 2022.

Among traders there have been growing concerns that President-elect Prabowo Subianto’s vast spending plans could burden the Southeast Asian country’s budget, even as reports over a cabinet rift have emerged.

“We see short-term pressure arising from a firmer dollar, lackluster sentiment for Indonesian bonds and strong domestic dollar demand,” said Mitul Kotecha, head of FX and EM macro strategy for Asia at Barclays Plc.

Investors will be keeping a close eye on the nation’s first-quarter current account deficit, which widened by $1.3 billion in the final three months of last year. Indonesia’s trade surplus in February narrowed to the smallest in nine months to $867 million amid a slump in commodity exports.

Regional Pressure

Asian currencies came under pressure in March, pushing a Bloomberg gauge of the region to the lowest since November. The dollar pushed higher on bets the Federal Reserve will keep its policy rate higher for longer and not cut it any time soon.

“Sentiment toward Asian foreign-exchange including the rupiah has been weighed down by concerns related to the Fed possibly slowing down easing this year given strong US data,” said Alan Lau, a foreign-exchange strategist at Maybank in Singapore. “However, we stay wary of further weakness given that the dollar is stretched and the possibility that Fed officials could still reiterate the possibility of cuts this year.”

Stocks fell on Tuesday as well, with the Jakarta Composite Index sliding to the lowest level since January.

Intervention Risk

The rupiah’s decline will likely fuel speculation about the possibility of official support for the currency, a common theme in Asia at the moment. Japan’s currency chief has delivered his most robust warning on the yen in months, while Chinese authorities have been bolstering the yuan with their daily reference rate.

“Official intervention to prop up the rupiah may be a risk, especially as we approach the 16,000 handle,” said Mingze Wu, currency trader at Stonex Financial in Singapore. “A runway rupiah may also deter foreign funds from coming in.”

In October, Bank Indonesia surprised markets by hiking its key rate to bolster weakness in the currency at that time.

“We suspect another heavy FX intervention may be coming in what will be a seasonally weak period for the rupiah ahead,” said Satria Sambijantoro, an economist at PT Bahana Sekuritas. “Bound by its dovish guidance, BI faces an uphill battle to defend the rupiah as it will have less flexibility and credibility when looking to hammer FX speculators.”