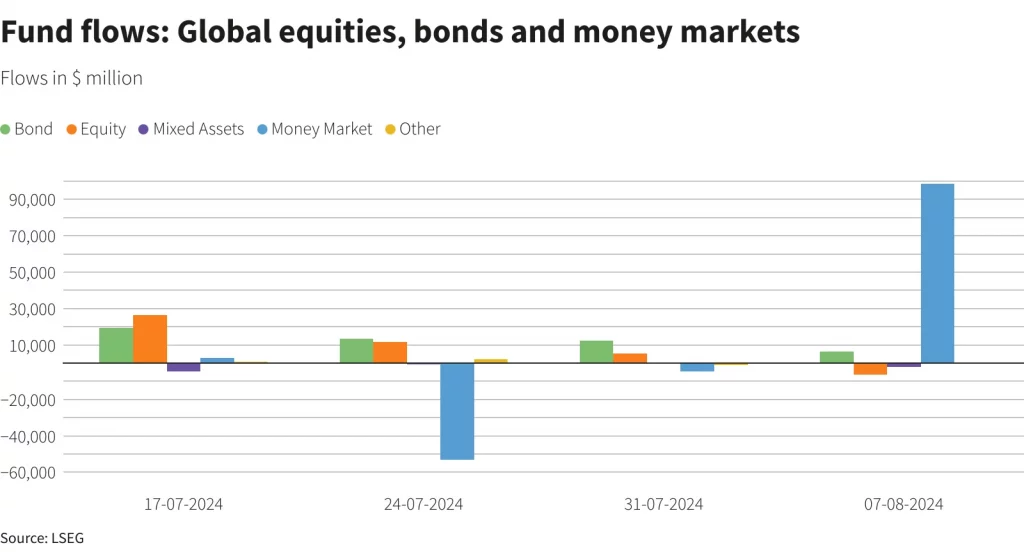

London August 9 2024: Global investors funnelled substantial amounts into money market funds in the seven days to Aug. 7 as they rushed for safety amid a surge in market volatility triggered by fears of a U.S. slowdown and a strengthening yen that prompted unwinding of carry trades.

According to LSEG data, investors purchased a hefty $98.58 billion worth of global money market funds during the week – their largest weekly net purchase since April 3.

Weaker than expected U.S. payrolls and a sharp contraction in July’s manufacturing data reignited concerns that a recession could be looming, potentially impacting global companies reliant on exports to the United States.

Japan’s Nikkei share average (.N225), plummeted 12.4% on Monday, its largest single-day fall, amid a yen surge, evoking memories of the ‘Black Monday’ stock market crash in October 1987.

That risk-off sentiment prompted an outflow of $6.33 billion from global equity funds during the week, the first outflow in seven weeks.

By region, investors offloaded a net $7.39 billion from U.S. equity funds after three weeks in a row of net purchases. European funds also had $4.54 billion worth of outflows, while Asian funds drew inflows of $4.61 billion.

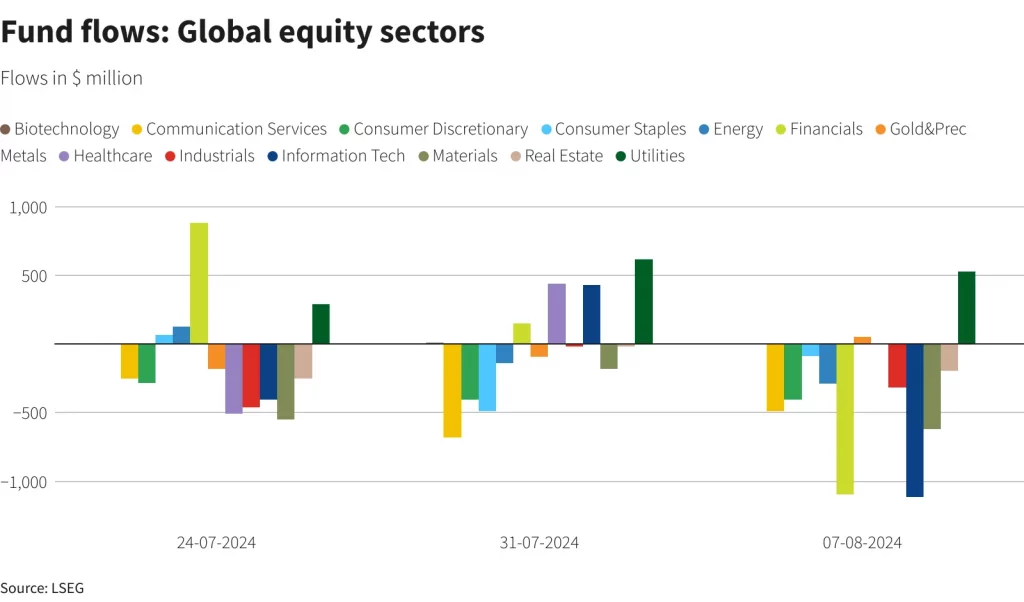

By sector, tech and financials saw significant outflows, amounting to $1.11 billion and $1.09 billion respectively, while utilities attracted their sixth consecutive weekly inflow, totalling $529 million.

Global bond funds, meanwhile, were favoured for the 33rd week in a row with a net $6.26 billion in inflows.

Global investors continued their buying streak in corporate bond funds, marking a 10th consecutive week of net purchases with $2.06 billion. Meanwhile, government bond funds attracted $1.32 billion, but loan participation funds saw $2.98 billion in outflows.

Among commodities, investors acquired Energy funds worth a net $208 million, extending net purchases into a fifth successive week. Precious metal funds, meanwhile, had $700 million in outflows, the first in four weeks.

Data covering 29,593 emerging market funds showed a net outflow of $2.79 billion from equity funds, the ninth weekly net selling in a row. Bond funds however, gained $1.49 billion worth of inflows.