Addis Ababa October 3 2024: Ethiopia proposed that holders of its $1 billion bond take an 18% loss in a debt restructuring, even as it acknowledged that an influential group of investors has rejected such an offer in advance.

The government held a call with global investors on Tuesday to spell out its debt-rework strategy, while noting major obstacles to progress. A group of creditors had already dismissed a haircut in August, saying that any reductions to the principal amount that the Horn of Africa nation owes them were unnecessary.

“Bondholders indicated that they do not wish to engage with Ethiopia on the basis of the current debt diagnosis, based on the IMF debt sustainability analysis assessment and requirements,” Ethiopia said in its presentation on Tuesday. “Despite this roadblock, we remain committed to working with the representative bondholders committee.”

At the heart of the issue is a forecast about the degree of economic hardship facing Ethiopia if it makes the larger payments. That’s based on a so-called debt sustainability analysis by the International Monetary Fund that Ethiopia and the bondholder group disagree on: Ethiopia said that indicators show a “solvency issue, albeit by a small margin.” Bondholders have argued that the nation only faces a potential liquidity crunch.

The bondholder committee has said it holds more than 40% of the bonds, which means it would be able to block any agreement on debt restructuring with the government.

The group is represented by Newstate Partners LLP and Weil, Gotshal & Manges LLP as financial and legal advisers, respectively. Morgan Stanley Asset Management, Farallon Capital Management LLC and VR Capital Group Ltd. are part of the group, according to people familiar with the matter, who asked not to be named because the composition is private.

A representative from the creditor group declined to comment.

Debt Relief

Ethiopia is using the Group of 20’s Common Framework guidelines to restructure its external debt, which includes $12.4 billion owed to bilateral creditors. Under the framework, the IMF’s debt sustainability analysis lays out the economic parameters dictating how much relief lenders need to provide, and forms the basis for negotiations with all creditor groups.

After securing a $3.4 billion loan from the IMF in July, Ethiopia needs to renegotiate the debt it owes to both bondholders and to country-level creditors such as China and France, which are grouped together in an official creditor committee, or OCC. In its presentation, Ethiopia said it was inviting bondholders to negotiate in parallel with the OCC process.

Though the government and private bondholders failed to reach a deal after a round of formal talks last year, the country said tangible progress has been made toward an agreement in principle with bilateral creditors, and that it expects to reach an agreement by the end of the year.

Here are some of the key terms of what the government is seeking from bondholders:

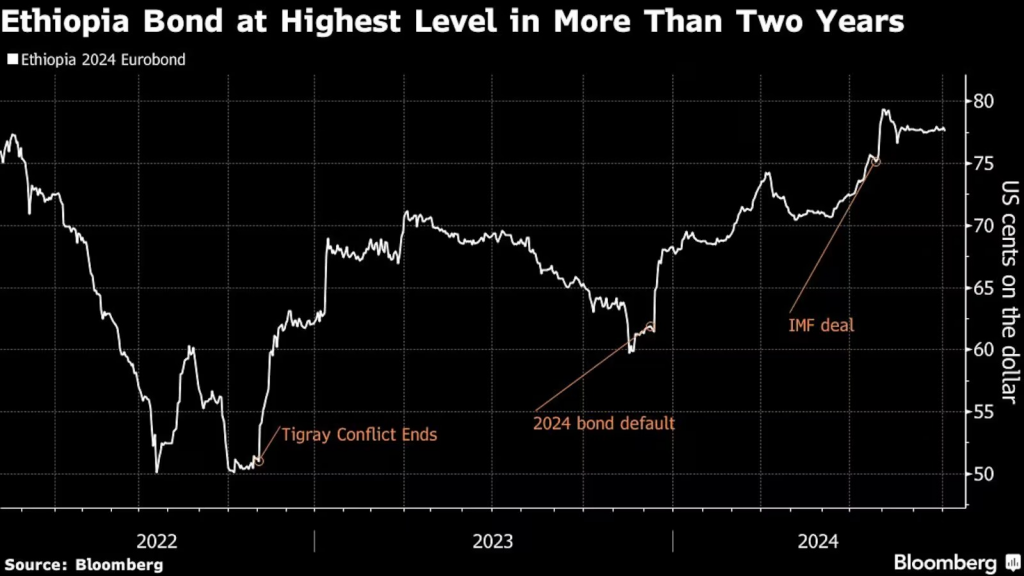

Ethiopia defaulted on its $1 billion eurobond in December. The 2024 note traded at 77.65 cents on the dollar as of midday Wednesday, according to data compiled by Bloomberg.

Ethiopia’s external debt as of June 30 rose to $28.2 billion, according to the debt statistics bulletin issued by the Ministry of Finance, of which about 70% was owed by the government and most of the rest by state-owned enterprises. The increase was partly attributed to fluctuations in currency rates and a rise in disbursements during the reporting period.