Beijing June 10 2023: After being wrong-footed by a $1.5 trillion rout in Chinese stocks, some of Wall Street’s biggest banks are coming around to a less optimistic consensus.

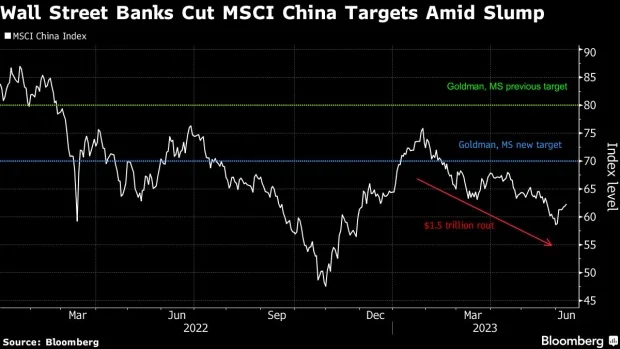

Strategists at Goldman Sachs Group Inc., Nomura Holdings Inc. and Morgan Stanley have all slashed their MSCI China Index targets over varying periods by at least 11%. Their latest projections suggest that while the gauge may rebound from current levels, it will struggle to reclaim the high seen in January, when the reopening frenzy was at its peak.

Such recalibration comes after a slew of data misses that cast a pall over the economic recovery. Tensions with the US have also played a role, while the key property market remains in the doldrums. For those banking on authorities to ramp up stimulus, measures so far have been targeted at best.

“On the index level, we frankly think the Chinese market may tread water, grow a little bit in the second half, but probably not offer that much,” said David Wong, senior investment strategist for equities at AllianceBernstein Holding LP. While there has been a reopening boost, “it’s been more limited than people had anticipated,” he said.

Going long Chinese equities was the unanimous call among Wall Street banks heading into 2023 as Beijing’s shift away from Covid Zero spurred bets for a speedy recovery. Most strategists turned overweight, expecting the MSCI China Index to extend a surge of almost 60% from the end of October to late January.

Even when the gains started to fizzle out, few expected the downturn to be this prolonged and steep. The gauge has lost close to 20% from its Jan. 27 peak, shedding about $1.5 trillion at the depth of the rout. The Hang Seng China Enterprises Index has also tumbled into a bear market, while the CSI 300 benchmark for mainland shares has erased all its gains for the year.

What’s made matters worse is the rising appeal of some other Asian markets and a lack of strong catalysts for China. While hopes are running high for more policy stimulus, including a potential cut in interest rates, a sweeping set of stimulus promises — which helped reverse the March 2022 rout — is less likely as authorities seek to keep leverage in check.

All of this is not to say China has become uninvestable. Goldman Sachs and Morgan Stanley have maintained their overweight recommendations despite index forecast cuts, expecting a degree of recovery from here.

Valuations are also too attractive to ignore for some like JPMorgan Asset Management and Invesco Asset Management Ltd. Certain groups of stocks, such as state-owned enterprises and those linked to artificial intelligence, may continue to outperform given policymakers’ focus on these sectors.

“I would expect to see some better second half of the year,” said Societe Generale SA’s head of Asia equity strategy Frank Benzimra, who has held a neutral rating on Chinese equities since November. “From a strategy perspective, we would need a higher level of risk premium to be comfortable. But from a technical point of view, we could see some rebound.”

Still, expectations for market returns seem longer term modest thanks to perennial policy uncertainty and doubts over whether China will be able to regain its former pace of economic expansion and industrial growth.

A recovery in corporate earnings is also starting to look shaky after a tepid first quarter. Forward earnings estimates for the MSCI China gauge have slipped 4.7% from a February peak, given softer recovery expectations and intensifying price wars in some sectors.

“It’s the longer-term sustainability of the recovery that gets investors worried now,” Morgan Stanley’s chief China strategist Laura Wang told Bloomberg Television this week. “So what we are seeing here is absolutely slower earnings growth versus our previous expectation.”