London February 26 2023: A cohort of Wall Street’s emerging-market bulls is growing wary of calling a new dawn for riskier assets, opting for a more cautious approach to developing-nation currencies.

With the bulk of Federal Reserve aggressive rate increases already over, some of the world’s top investors predict the dollar will soon fall into a multi-year weakening trend. Such a shift stands to support emerging markets — and indeed propelled gains of nearly 9% in developing currencies from late October to early February.

But this month’s market turmoil amid a greenback bounce has given pause to some would-be buyers.

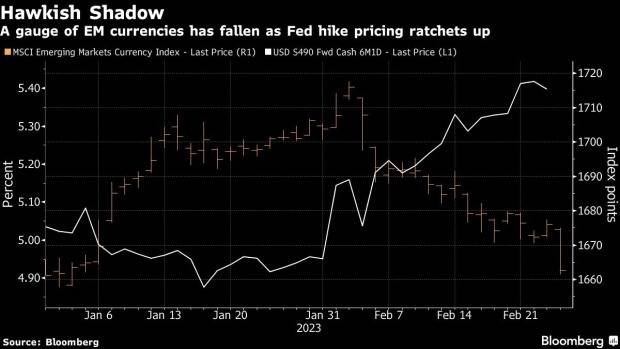

Money managers from abrdn Plc to Fidelity Investment are wary of being caught on the wrong side of the latest dollar rally, especially after the MSCI Inc. gauge of developing currencies wiped out almost all of its year-to-date gains.

“We are concerned on a more tactical basis that EMFX has moved too far too fast,” said James Athey, investment director of rates management at abrdn in London. “The Federal Reserve is not yet done hiking, there remains much uncertainty around the inflation outlook, and we fully expect a US/global recession in the next six to 12 months.”

That uncertainty was on full display Friday after a surprise acceleration in the Fed’s preferred price gauge bolstered odds of higher-for-longer US rates and boosted the dollar.

Declines were exacerbated in the benchmark for developing-nation currencies, which is set for the worst month since September. A JPMorgan Chase & Co. gauge of appetite for emerging-market currency risk has also fallen this month, turning negative in mid-February for the first time this year.

Thailand’s baht has already given up all of its early-2023 gains, which had come amid optimism around returning Chinese tourists. And South Africa’s rand — often seen as a proxy for risk appetite — is back to levels last seen in late 2022.

Even before Friday’s dollar surge, abrdn had taken a neutral stance on the asset class, looking for valuations to fall and reflect a recession. Investors at Fidelity International are now buying the dollar against the Philippine peso and Polish zloty.

Goldman Sachs Group Inc., meantime, is warning of a struggle ahead for the US rate-sensitive South African rand.

Pockets of Resilience

But there’s still a case for selectivity as currencies from certain developing economies withstand the recent greenback strength.

Helped by domestic inflation cycles and commodities, the Mexican peso and Peruvian sol have so far bucked the trend to strengthen against the dollar in February.

“The LatAm block appears to be much further ahead on the inflation and policy tightening cycle compared to other emerging markets,” said Paul Greer, a London-based money manager at Fidelity. “This has resulted in the region offering very high ex-ante real yields, which is supportive of foreign portfolio inflows entering local bond and FX markets.”

For Alvin Tan, head of Asia FX strategy at RBC Capital Markets in Singapore, certain Asia currencies are also better positioned to withstand a period of dollar strength, especially if too-tight monetary policy triggers economic recession in major economies.

“The Korean won and Thai baht still look relatively cheap to me,” he said. “If indeed Asia can avoid a recession this year, then I expect further upside to regional assets and FX.”

What to Watch

- Investors will closely watch the results and impact of Nigeria’s election after Saturday voting. The nation has contended with widespread shortages of both gasoline and naira notes, leading to chaotic scenes at gas stations and banks.

- China’s PMI surveys will give a read on how the recovery is progressing in February, with Bloomberg Economics anticipating good news.

- India and Turkey will release GDP data, offering clues on how emerging-market growth held up in the final stretch of 2022.

- Brazilian GDP figures and December employment data are expected to show the economy lost momentum in the fourth quarter, according to Bloomberg Economics.

- Mexico’s central bank is scheduled to release a quarterly inflation report that offers its latest economic forecasts and clues on the path of monetary policy ahead.