Paris October 10 2022: The expansion of French industrial activity has ground to a halt in the face of rising uncertainty and surging energy prices, according to the Bank of France’s monthly business survey.

The central bank’s poll of 8,500 firms showed a stabilization in September instead of a slight increase as previously expected. Business leaders in industry predict another stagnation in October, and also reported a further deterioration of their cash positions amid rising energy costs.

While the picture for services is more upbeat, the rate of increase in activity will slow this month, according to the survey. The Bank of France trimmed its economic growth estimate for the third quarter to 0.25% from 0.3%.

“Services are continuing to resist well, and are even growing in September and probably October,” Francois Villeroy de Galhau said in an interview with France Culture radio. “However, industry is starting to suffer, and that’s the phenomenon that’s a bit new and which unfortunately isn’t very surprising because it’s linked to the strong rise in energy bills.”

The French economy had been showing greater resilience at the start of the fall, following strong growth in the second quarter. But the prolonged surge in energy prices is putting a strain on factories and testing the limits of government measures to mitigate the higher costs. Statistics agency Insee said last week it expects economic growth to fade to zero in the final quarter of the year.

Villeroy stuck to the bank’s forecast for 2.6% growth this year followed by a “clear slowdown” next year. He reiterated the bank’s estimated 2023 range between a contraction of 0.5% and an expansion of 0.8%, citing “a lot of uncertainty.” The outlook assumes a stable fourth quarter this year.

Suffering Sectors

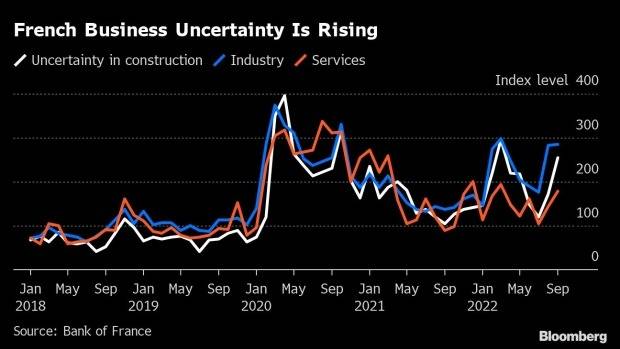

The central bank’s measure of uncertainty based on an analysis of written responses rose again in September, with entrepreneurs citing concerns about energy in particular. In industry, assessments of order books also deteriorated.

“Uncertainty is rising very strongly on the industry side,” Villeroy said. “They don’t know how much their energy is going to cost and in some cases they don’t even know if it’s going to be available. There are cash flow tensions among industrial firms.”

Sectors such as chemicals and steel, which consume the most energy, are suffering the most, he added.