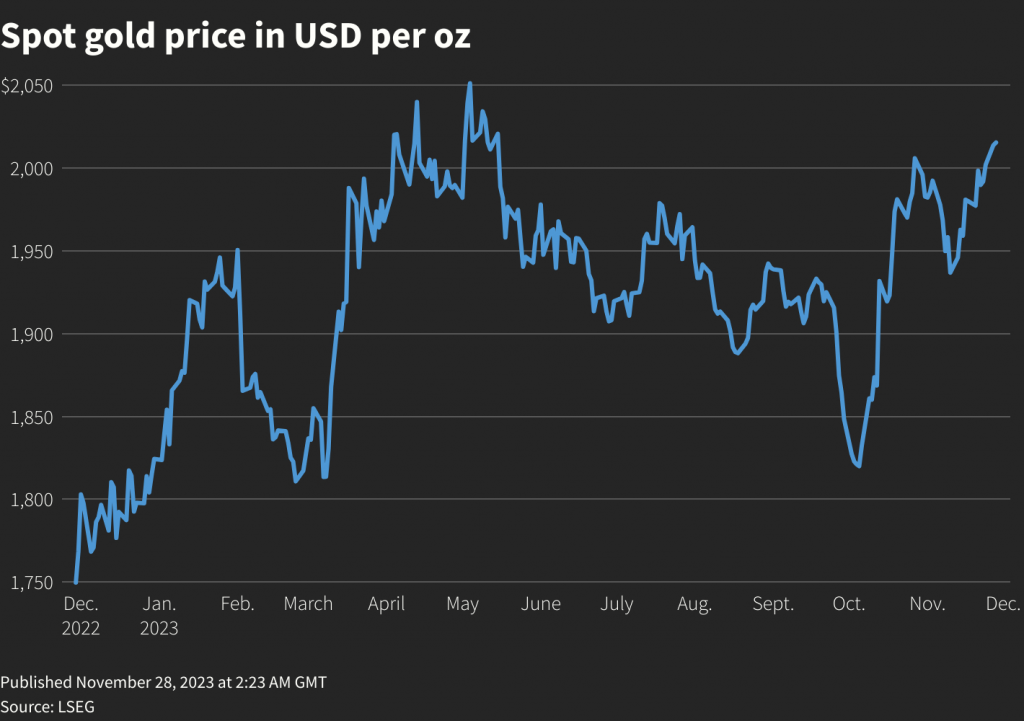

US November 28 2023 : Gold steadied after touching a six-month peak on Tuesday, as expectations of an end to the U.S. Federal Reserve’s interest rate hike cycle kept the dollar and bond yields under check.

Spot gold was little changed at $2,014.12 per ounce by 0412 GMT, after hitting its highest since May 16.

U.S. gold futures for December delivery rose 0.1% to $2,014.20 per ounce.

“Lower bond yields and bets the Fed may cut sooner than originally thought have certainly helped gold shine,” City Index senior analyst Matt Simpson said.

The dollar index (.DXY) touched its lowest since late August against its rivals, making gold less expensive for other currency holders. Yields on 10-year Treasury notes hovered near two-month lows of 4.3630%.

Recent data showing signs of slowing inflation in the U.S. has boosted expectations that the Fed could begin easing monetary conditions sooner than expected, with the market now awaiting Personal Consumption Expenditures (PCE) data – Fed’s preferred inflation gauge – on Thursday.

“It simply comes down to whether inflation continues to soften at a quick enough pace to justify bets of rate cuts. And my bet is that it won’t, and that gold may find that bump in the road,” Simpson said.

“If so, I’d look for evidence of support around 1,990 or 1,960 as there was a lot of trading activity in that area.”

Traders widely expect the U.S. central bank to hold rates in December, while pricing in about a 50-50 chance of easing in May next year, CME’s FedWatch Tool shows.

Lower interest rates reduce the opportunity cost of holding non-interest-bearing bullion.

Investors’ attention is also on the revised U.S. third-quarter GDP figures, due on Wednesday.

Meanwhile, net gold imports into top consumer China via Hong Kong fell for a second consecutive month in October as a patchy economic recovery weighed on demand in the key bullion market, data on Monday showed.

Spot silver fell 0.3% to $24.55 per ounce, platinum was down 0.5% to $913.90. Palladium fell 0.8% to $1,061.41 per ounce.