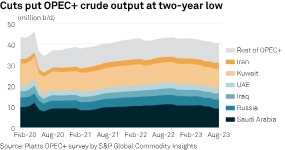

London September 8 2023: OPEC+ crude oil output grew by 120,000 b/d in August as by increases in Iran, Iraq and Nigeria more than offset further reductions by Saudi Arabia and Russia, according to the latest Platts survey by S&P Global Commodity Insights.

OPEC+ production averaged 40.52 million b/d in the month, with the 13 members of OPEC producing 190,000 b/d month on month. Output from the non-OPEC countries in the coalition contracted by 70,000 b/d.

Even with the net increase, the group’s output remains well below levels earlier this summer, with Saudi Arabia implementing a voluntary 1 million b/d cut since July to help bolster market prices.

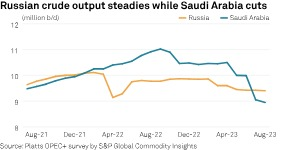

Saudi Arabia’s crude production was 8.95 million b/d in August, down 100,000 b/d month-on-month and at its lowest since May 2021, the survey showed.

The biggest non-OPEC producer in the group, Russia, lowered production by 20,000 b/d month to 9.4 million b/d in August. Russia in July had pledged a 500,000 b/d supply cut, but specified that it pertains to exports, not production. It has since said it will ease back its cut to 300,000 b/d from September.

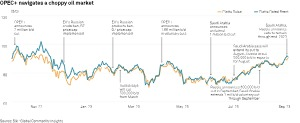

The Saudi restraint — which comes on top of smaller cuts made by other OPEC+ members since May — has largely been credited for the recent rise in crude prices to 10-month highs, as they come at a time when many forecasters are expecting a tight market.

Saudi Arabia and Russia on Sept. 5 announced they would extend their cuts through the end of 2023, which will contribute to what analysts at S&P Global estimate to be a 1.8 million b/d supply deficit in the second half of the year.

Platts, a part of S&P Global, assessed Dated Brent at $91.40/b on Sept. 6, up 22% since the end of June.

Output increases in Iran, Iraq and Nigeria are mitigating the impact of the major Saudi cut.

Iranian production of 2.95 million b/d was the highest since November 2018, according to the survey, as its exports to China remain strong. Sanctions pressure on Iran has also eased considerably as Western countries focus on measures against Russia in response to its invasion of Ukraine, enabling customers to take more Iranian crude without fear of enforcement. Iran is exempt from a production quota under the OPEC+ agreement.

Production in Iraq grew 110,000 b/d as internal consumption increased, while Nigerian output was up 60,000 b/d, as loading resumed at the Forcados terminal, after an underwater leak disrupted loading for a month.

On the non-OPEC side, Kazakhstan saw a 50,000 b/d drop in output on field maintenance, while the remaining allies kept production steady, according to the survey.

Shortfalls

The OPEC+ alliance collectively continues to produce significantly below its quotas, with the total shortfall 1.1 million b/d in August, according to the survey.

OPEC countries that are taking part in the cuts produced 687,000 b/d below their combined quotas in August, with many African members having struggled for months to reach their targets. Under a deal agreed by the group in June, many of the underproducing countries have until November to demonstrate higher production or risk a permanent reduction to their quotas.

Besides Iran, Libya and Venezuela are also exempt from quotas.

OPEC+ officials have said they will review their production levels monthly and adjust them as market conditions warrant. The next meeting of the OPEC+ Joint Ministerial Monitoring Committee that oversees the agreement and is co-chaired by Saudi Arabia and Russia is scheduled for Oct. 4.

The full 23-country OPEC+ alliance is not scheduled to meet until Nov. 26. Under the agreement, the group can call extraordinary meetings, and has done so in the past.