Islamabad February 6 2024: Pakistan’s Oil and Gas Regulatory Authority (OGRA) has announced a further increase in gas tariffs for Sui Northern by 35.13 percent and Sui Southern by 8.57 percent, retroactively effective from January 1, 2024.

This adjustment aims to address the PKR 98 billion shortfall until June 30, 2024, marking the second gas price hike in the current fiscal year 2023-24.

On February 2, 2024, the regulator recommended an average increase in the prescribed gas price by 23.16 percent, raising it to PKR 1,590 per MMBTU from the previous average of PKR 1,291 per MMBTU set on June 2, 2023. The IMF has urged the government to implement biannual gas price reviews to alleviate the circular debt, currently standing at Rs1,250 billion.

OGRA is obligated to announce gas tariffs biannually, with the government enforcing prices on July 1 and January 1 in any given fiscal year.

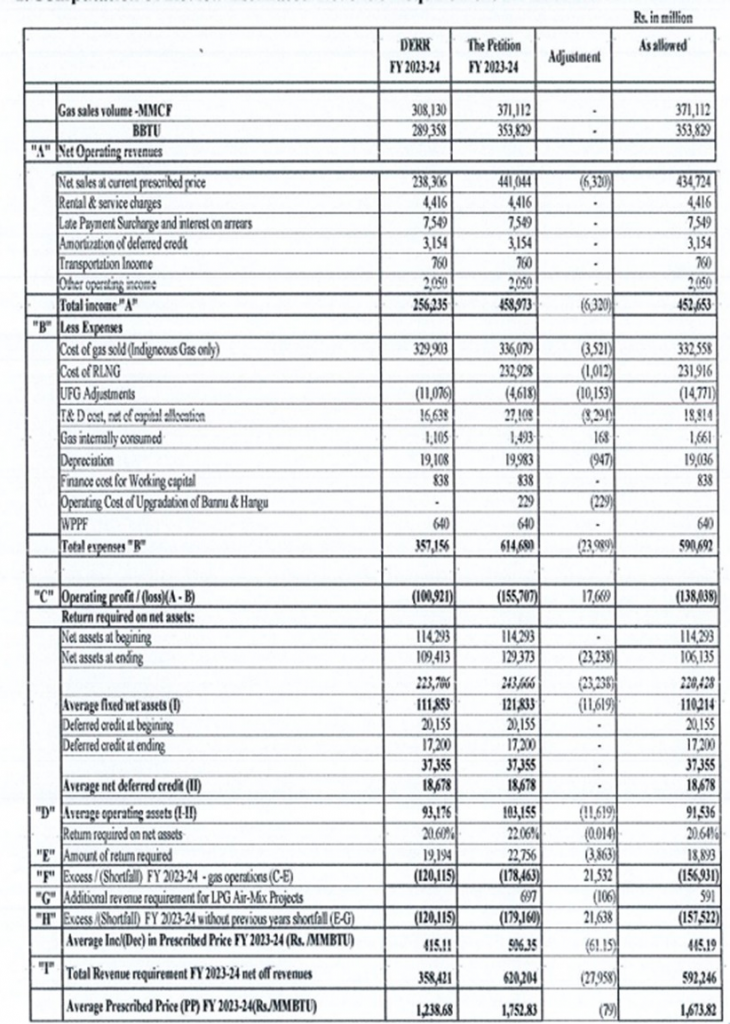

According to OGRA’s decisions published on February 2, 2024, on its official website, the tariff for Sui Northern gas has surged to PKR 1,673.82 per MMBTU from PKR 1,238.68 set on June 2, 2023.

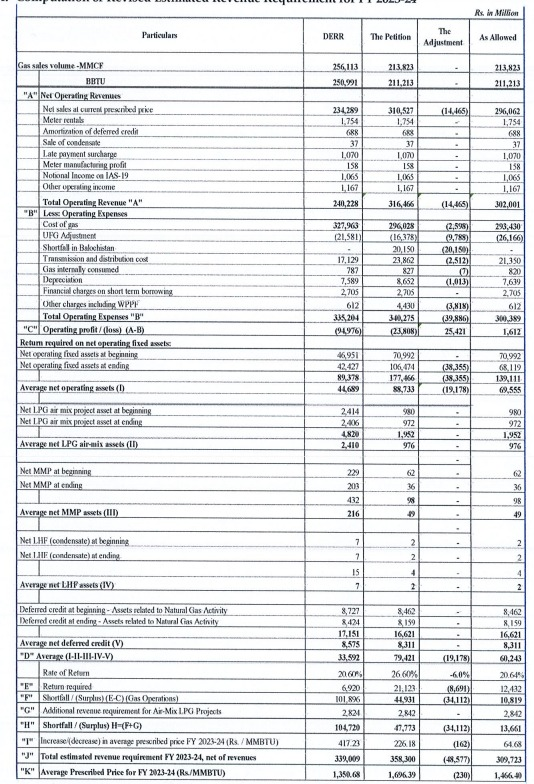

Similarly, the regulator has raised the gas tariff for Sui Southern to PKR 1,466.40 per MMBTU from PKR 1,350.68 per MMBTU.

“This comparison reflects gas price adjustments effective from January 1, 2024, compared to the earlier determination effective from July 1 in the fiscal year 2023-24,” according to the notification.

The government has received OGRA’s determination and is currently reviewing it. Under the OGRA ordinance, if the government fails to respond to OGRA’s determination within 40 days, the regulator’s tariff will automatically take effect.

Previously, on June 2, OGRA had announced a 50 percent increase (PKR 415.11 per MMBTU) for consumers of Sui Northern Gas Pipeline Limited (SNGPL), raising the gas price to PKR 1,238.68 per MMBTU effective from July 1, 2023. It also increased the gas price by 45 percent (PKR 417.23 per MMBTU) to PKR 1,350.68 per MMBTU for consumers of Sui Southern Gas Company Limited (SSGCL) for the fiscal year 2023-24. The caretaker government had increased gas prices by up to 193 percent effective from November 1, 2023, with an estimated revenue tariff of PKR 980 billion in FY24.

However, the government’s earlier assertion that the substantial increase in gas prices effective from November 1, 2023, would halt monthly inflows into the gas circular debt for the fiscal year 2023-24 proved inaccurate.

“The deficit of PKR 98 billion will be addressed through an average increase of 23.16 percent for both gas companies,” an official informed The News.