Karachi July 4 2024: The banking sector continued its steady performance and remained resilient in terms of its operational and financial soundness in a challenging economic environment during CY23, according to Financial Stability Review (FSR) for CY 2023 issued by State Bank of Pakistan.

Assets base of the sector expanded by Rs 10,568 billion or 29.5 percent to touch Rs 46,364 billion by end December, 2023, which is a 20- year high growth. The expansion in assets was mainly driven by investments (largely government securities), while growth in advances moderated due to a challenging macroeconomic environment.

Assets composition further tilted towards investments, constituting around 56 percent in assets by end December 2023. The rising share of government securities on balance sheet of banks reflects the structural imbalances in the economy such as large fiscal deficit leading to the government’s increased reliance on domestic resources, especially banking sector, to meet its financing needs.

Investments increased by Rs 7,619 billion, expanding at a 14-years high rate of 41.4 percent in CY23, higher than 26.4 percent in CY22.

Around 98 percent of the expansion in investments emanated from increase in the government securities. The pattern of investments, remained tilted towards shorter tenor MTBs and floating rate PIBs, constituting around 58 percent of total investment. However, banks also showed interest in fixed-rate instruments such PIBs and Fixed Rental Rate Sukuk in auctions, which may reflect their view about inflection point of the tightening cycle.

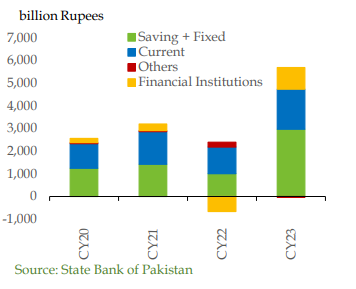

On funding side, deposits increased by Rs 5,667 billion or 24.2 percent in CY23, a 20-years high growth. The major impetus came from rate sensitive deposits as banks’ deposit rates responded to the high policy rates.

Composition of Deposit Mobilization

A lackluster demand due to weak economic activity and tight macro-financial conditions coupled with risk averse strategy of banks dampened the growth in loan portfolio. While deposit growth remained healthy in a higher return environment, however, the higher pace of investments in government securities increased the

banks’ reliance on borrowings. Earnings indicators improved mainly on the back of higher net interest/markup income.

In contrast to double-digit growth rates in last two years i.e. 22.1 percent in 2021 and 16.8 percent in 2022, growth in advances decelerated to 3.0 percent, mainly reflecting lackluster credit demand amid subdued economic activity and tight macro-financial conditions. This deceleration was mainly driven by domestic advances, which constitute 94.2 percent of banking sector’s total loan portfolio, reflecting that a challenging domestic macro-financial environment and subdued economic and largescale manufacturing activity coupled with high public sector borrowings weighed on private sector credit during CY23.

Despite subdued economic activity and tight financial conditions, the assets quality indicators of banks manifested muted risk to solvency. Liquidity profile in terms of liquid assets vis-à-vis liabilities remained comfortable – augmented by the increased investments in government securities.

In the backdrop of a conservative regulatory regime, banks could comfortably manage currency and equity price movement risks, while the market risk also remained contained due to relatively shorter repricing maturity of investment portfolio. Baseline solvency indicator viz. Capital Adequacy Ratio (CAR) at 19.7 percent not only strengthened further on the back of higher earnings but also stood well above the minimum regulatory requirements.

Islamic Banking Institutions (IBIs) maintained their growth momentum and sound financial position, which contributed to the overall stability of banking sector.