Moscow June 1 2023: A lopsided trade relationship with India is forcing Russia to accumulate up to $1 billion each month in rupee assets that remain stranded outside the country, swelling the stockpile of capital it’s amassed abroad since the invasion of Ukraine.

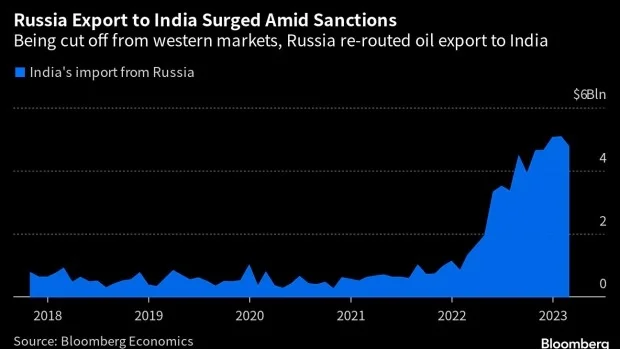

Russia has emerged as a top supplier of oil to India over the past year, settling a greater share of trade in national currencies and redirecting shipments east as traditional customers in Europe shunned purchases after the war began over a year ago.

But with imports from India stagnating, Russia is ending up with an excess of rupees, which its companies have trouble repatriating because of local currency restrictions. Deadlock over a solution has left Russia expecting the surplus to rise further, according to people familiar with the negotiations.

Every quarter, the imbalance will likely generate the equivalent of $2 billion to $3 billion that Russia can’t use, according to Bloomberg Economics. The amount would add to an estimated $147 billion in net foreign assets built up abroad over the course of 2022.

“The reason is a sharp boost in the volume of oil supplies from Russia,” said Irina Zasedatel, a member of the presidium of Russia’s Association of Exporters and Importers. “Against the backdrop of an increase in the growth of oil sales, there’s little sign of expansion in the supply of other goods.”

An impasse at the negotiating table between India and Russia is complicating their booming one-way trade. In the first quarter, India had a trade deficit $14.7 billion with Russia.

A top priority for India is to promote the wider use of the rupee in international settlements. The central bank has suggested that countries accumulating excess rupees from exports can put the funds in local securities including government bonds.

The two countries are discussing various payment mechanisms including investments in India’s capital markets by Russian entities.

It’s an option that initially didn’t find favor with Moscow but is now back on the table as billions of rupees pile up in Indian banks, officials in India familiar with the details said, asking not to be named because discussions were private. Other possibilities include channeling the accumulated rupees into Indian infrastructure projects in exchange for equity stakes.

For Russia, the only acceptable option is to use currencies of a third country, such as China’s yuan or the United Arab Emirates dirham, said people familiar with the deliberations. An agreement is far off since Russia has limited sway in a situation with few alternative buyers to India, they said, asking for anonymity to describe the private talks.

Russia’s government and its central bank didn’t respond to requests for comment, and neither did India’s Ministry of External Affairs.

“Russia’s trade with India is increasingly imbalanced. India’s exports to Russia haven’t caught up with booming imports, but there’s a limited appetite in Russia to save its current-account surplus in rupees. That said, there are no alternative oil importers of India’s caliber on the horizon for Russia, so exporters and banks will gradually accept settlement in rupees. This will allow Russia to keep its oil flowing, but will make hard currency more scarce, weaken the ruble and push inflation higher.” Alexander Isakov, Russia economist.

Though changes in how the government in Moscow taxes oil companies have succeeded in stabilizing public finances after a record surge in spending, the inability to retrieve earnings deprives Russia of hard currency at a time when its exporters already face longer wait times for payments because many domestic banks have lost access to their correspondent accounts in the west.

In the months following the invasion, households and companies have also been moving billions of dollars in funds to banks abroad. And with some foreign revenue now trapped overseas, pressure on the ruble may grow worse since fewer export proceeds will be converted into the Russian currency.

The warping of commerce leaves few good options for the Kremlin and underscores how little bargaining power it has in a redrawn global oil market that’s seen Asian powerhouses India and China scoop up cheaper Russian oil. It also shows why a shift away from the currencies of Russia’s adversaries remains fraught with risks.