Seoul April 7 2023: Samsung Electronics Co. is cutting memory chip production after reporting its slimmest profit since the 2009 global financial crisis, a significant step for the industry after oversupply caused prices to crater. Shares rose.

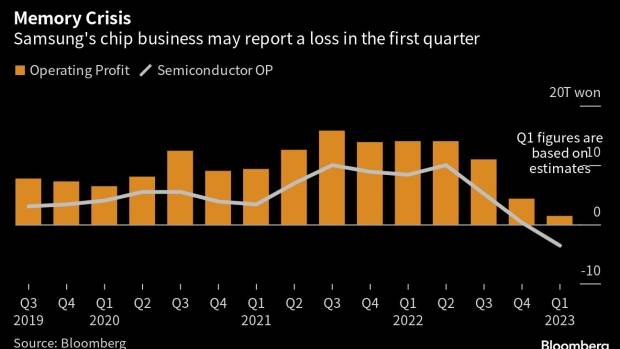

Operating profit plunged more than 95% to 600 billion won ($450 million) for the three months ended March, missing the average analyst estimate of 1.4 trillion won. Sales fell to 63 trillion won.

Samsung said it would cut memory chip production to a “meaningful level,” a move competitors had been waiting for after a pileup of inventory hurt pricing and profits. The largest maker of memory chips had resisted pulling back in recent months, in part to grab market share from rivals.

“Under the assessment that the company has secured enough volume to respond to future memory demand changes, Samsung is adjusting to lower memory production to a meaningful level centering on products that have secured additional supply as well as optimizing line operations that’s already underway,” it said in a statement.

Its shares rose as much as 3.9% Friday morning.

Inventory at Samsung had swelled to 52.2 trillion won at the end of last year after the company maintained production despite a collapse in demand. In contrast, rivals SK Hynix Inc. and Micron Technology Inc. had already cut output to deal with historic stores of chips. Hynix shares surged as much as 5.7%.

“Samsung’s output cut is a meaningful move,” said Lee Seung-Woo, an analyst at Eugene Investment & Securities. “Samsung’s output cut will likely move memory spot prices soon. There is almost no demand right now.”

Still, Samsung signaled it won’t pull back from its aggressive strategy.

“We have cut short-term production plans, but as we project solid demand for the mid-to-long term, we will continue to invest in infrastructure to secure essential cleanrooms and to expand R&D investment to solidify tech leadership,” it said in the statement.

Samsung plans to provide a full financial statement with net income and information on divisional performance later this month.

South Korea’s largest company had warned that earnings would fall in the first quarter on slowing sales. But memory prices tumbled more than anticipated because of sluggish demand for a wide range of electronics from smartphones to PCs, as consumers and companies navigated recession risks. Despite its post-Covid re-opening, China’s market has also not bounced back as quickly as some anticipated.

Samsung is estimated to have lost about $3 billion in its memory chip division.

The Covid pandemic whipsawed the semiconductor industry, leaving many of the biggest players struggling to keep up with market changes. Demand soared as consumers locked down at home bought new computers and smartphones. The trend quickly reversed as restrictions lifted and the global economy suffered economic shocks from rising inflation, surging interest rates and the war in Ukraine.

Prices of DRAM – a type of memory used to process data – are expected to fall in the current quarter by around 10%, according to Baik Gilhyun, an analyst at Yuanta Securities Co. That follows a roughly 20% slide in the previous three months and a more than 30% drop in the fourth quarter of last year.

Micron, the largest US maker of memory chips, has said customer inventories are declining, and predicted gradual improvements to the supply-demand balance. Hynix executives have said production cuts by memory suppliers should take effect in the second half and help prop up prices. But the two Samsung rivals underscored the pace of the recovery will hinge on peers’ efforts to cut supply.

The South Korean giant had resisted pulling back on capital spending and production until now. The company historically has opted not to slow down during difficult times so that it can take share from rivals. It’s spending hundreds of billions of dollars to build the world’s largest chip complex in its home country, and is building a new facility in the US too. The South Korean and US governments are both offering financial incentives to bolster their domestic industries.

Samsung’s signal of cuts could help bolster chip prices, a key step for profits to recover.

“Because it is adjusting production and lowering memory-chip output to a meaningful level, the supply-demand situation can improve much faster,” said Yuanta’s Baik. “Short-term concerns are coming to an end.”

It’s unclear how the US-China conflict over semiconductors might affect the industry in coming years. Last week, Beijing launched a security review of chips from Micron, spurring concerns the Chinese government is taking a more aggressive line toward American companies.

One reason Samsung managed to stay in the black during the first quarter was its smartphone division, bolstered by the launch of the new Galaxy S23 series. Sales of the phone lineup came to about 11 million units during those three months, up 50% compared with its predecessor, according to Hanwha Investment & Securities analyst Kim Kwangjin. The smartphone division’s profit rose 123% quarter-on-quarter to 3.3 trillion won, Kim estimated.