New York December 16 2022: Order is being restored in financial markets, a frightening development for equity bulls.

For the first time in a long time, news that was bad for the economy was bad for the stock market as well, more proof that recession fear has replaced inflation angst as that market’s biggest bugaboo. That bonds took the news in stride is nice for investors with a toe in each market, but adds to evidence that concern about the economy has become the bigger input to both.

Rather than rise on speculation that weak data would curb Federal Reserve tightening, the S&P 500 dropped 2.5% on Thursday, while the Nasdaq 100 lost 3.4%. Small-cap stocks lost more than 2.5% and the VIX volatility gauge shot back above 22. The yield on 10-year Treasuries hovered around 3.45%, down from a peak of 3.63% earlier this week.

“The concern is growth and what’s going to happen to the economy, and is the Fed pushing us into recession,” Mona Mahajan, senior investment strategist at Edward Jones, said on Bloomberg’s “What Goes Up” podcast on Thursday. “Markets won’t ignore the fact that we’re entering a downturn — and so could we head back toward those lows, give up some of the gains that we’ve seen recently? We think that is certainly a scenario that is a credible one.”

In months prior, bad economic news was often taken as good by investors because it suggested the Federal Reserve’s interest-rate increases were working as intended to cool the economy and tamp down inflation. But now a shift may be at hand: Many investors are worrying more about a recession in 2023, with the risk increasing that the Fed could overtighten.

Data Thursday suggested US economic growth is slowing, with retail sales and manufacturing dropping last month, though the labor market has remained strong. Retail sales fell in November by the most in nearly a year, calling into question the health of the consumer, while several factory measures also showed contraction, burdened by weaker demand, among other things. Meanwhile, regional Federal Reserve banks data showed that manufacturing weakened in both the New York and Philadelphia regions by more than expected — the latter’s new orders gauge fell to the lowest since the onset of the pandemic.

“Investors took their eye off the ball and were hoping for a glide path into the holidays,” said Mike Bailey, director of research at FBB Capital Partners. “Markets are realizing that we are in for a staring contest between Jay Powell and investors that could go on for three, six, or nine months.” He added that yields on short-term Treasuries rose Thursday, while those on longer-term ones declined, “which would support a theme of a hawkish Fed move near-term, pushing rates up, but also leading to perhaps a worse recession, which might suggest slower long-term growth and lower long rates.”

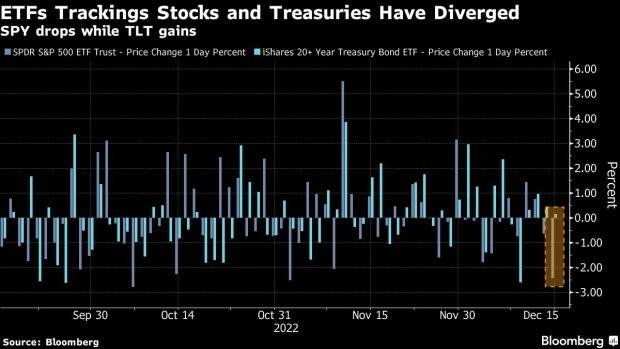

The iShares 20+ Year Treasury Bond ETF, known by its ticker TLT, is on pace to beat the SPDR S&P 500 ETF Trust (SPY) for five straight weeks, the longest winning streak since March of 2020. The Treasury fund is outperforming the latter by nearly 10 percentage points in December, poised for its best month since that period as well.

On Wednesday, the Fed raised its benchmark rate by 50 basis points to a 4.25%-to-4.5% target range and policymakers predicted rates would end next year at 5.1%, a higher level than previously indicated. Chair Jerome Powell reiterated that the central bank would keep rates higher for longer, and played down hopes for a rate cut next year.

The Fed also, among other projections, updated its forecast for the unemployment rate, saying it could rise to 4.6% next year — and such a hike from July’s trough of 3.5% “has never not caused a recession,” wrote Julian Emanuel, chief equity, derivatives and quantitative strategist at Evercore ISI, who added that no bear market has ever bottomed before a recession has started. Emanuel recommends a defensive position as the first half of 2023 could remain volatile still.

“The pullback in the market today — we aren’t surprised by it,” Nadia Lovell, UBS Global Wealth Management senior US equity strategist, told Bloomberg Television on Thursday. “This is a market that has traded on the hope that the Fed will not do what they say they will do. Yesterday they sent a clearly different message.”

“The risk is to the upside. That is what the market is grappling with today,” Lovell added. “We don’t yet think the bottom is into this market. You’ll probably see it in the first half of the year.”