London December 10 2022: Thematic investing can be traced as far back as 1948 when a mutual fund named the Television Fund was launched. And if it’s lasted this long, it can survive the ravages of an inflation-lashed year — at least as far as proponents like Kenneth Lamont are concerned.

Aggressive rate hikes by central banks as they battle surging prices have been brutal for thematic ETFs, a cohort of funds that target investments based on trends like robotics or electric cars. Rising borrowing costs have been hammering these riskier, speculative bets.

Yet Lamont, a nine-year veteran at Morningstar UK Ltd., sees reason for optimism. Even with an average drawdown of 30% for US thematic ETFs in 2022 — almost double the losses of the S&P 500 — outflows are less than 1% of the $115 billion in assets under management, data compiled by Bloomberg Intelligence show. It displays continuing faith in one of the hottest areas of investing that has helped power record-setting launches and growth for the $6 trillion ETF industry.

“It’s almost incredible how little the net outflow has been,” Lamont, Morningstar’s senior manager research analyst, said by phone. “If these were really being used trendily, we would’ve expected to see a sort of stampede for the door.”

Year-to-date, 53% of thematic funds are underwater since their inception. Launches in 2022 have slowed to 38 from the 77 seen in the previous year, while closures have picked up to 20 from five, data compiled by Bloomberg Intelligence show.

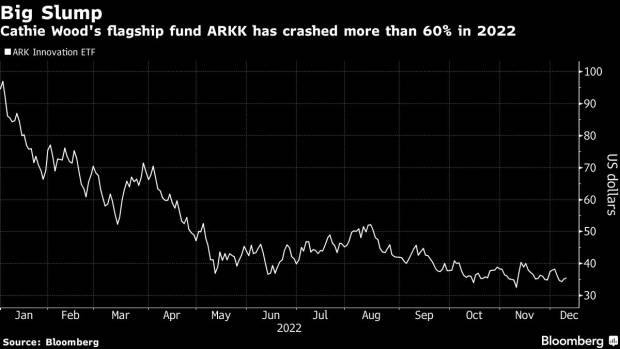

All the while, investors have stuck around. Most famously, Cathie Wood’s bellwether ARK Innovation ETF has added cash even as its price crashed 63% this year.

“From the demand side for these funds, the genie is out of the bottle,” said Lamont. “Thematic investing is captivating. We are narrative creatures and each fund and investment styles come with an inbuilt narrative.”

More broadly, as of Dec. 7, firms have launched 422 new ETFs this year, five more than the number seen over the same period in 2021. That total puts 2022 on track to surpass last year’s record for debuts, even amid recent market turmoil across asset classes.

Among thematic funds, innovation and emerging markets technology were the top themes driving inflows year-to-date to the tune of $2.2 billion and $1.8 billion respectively. Tech and communications saw the most outflows with $3.2 billion leaving such funds, followed by cloud computing at $1.2 billion and robotics and artificial intelligence at $941 million.

The flight of money may not come as a big surprise as the tech sector faced multiple headwinds this year. Companies including Twitter Inc., Meta Platforms Inc. and Amazon.com Inc. have slashed their workforces by the thousands while other firms have been trimming staff and slowing hiring as they grapple with higher interest rates and a pullback in consumer spending.

The backdrop for equities remains challenged for the year ahead as concerns about the impact of Fed policy on growth and corporate earnings run rampant. To Athanasios Psarofagis, a Bloomberg Intelligence ETF analyst, that suggests tougher times ahead in the thematic space.

“There’s likely going to be a purge,” he said by phone. “The market is going to be more difficult going forward, there’s just no way it will be able to support these.”

Issuers are unlikely to give up without a fight. Thematic ETFs charge a higher expense ratio by roughly 50 basis points compared to the average ETF, according to data by Bloomberg Intelligence — a compelling reason to keep them trading and even to launch more.

Still, Sylvia Jablonski, chief investment officer at Defiance ETFs, is bullish on the space. Investor conviction will be enough to support these funds, she said, most of which revolve around innovation, digitalization, artificial intelligence and advances in computing.

“As markets evolve and new themes become investable, investors are more comfortable with the diversification of innovation in a basket, versus banking on one name,” she said. “There have been so many advances in classic sectors like energy, tech, communication, pharma, alternative energy and that has opened the doors for issuers with great ideas.”