London February 13 2023: A fresh round of IMF bailouts is underway, and some of the world’s most indebted nations will have to sacrifice their currencies to get them.

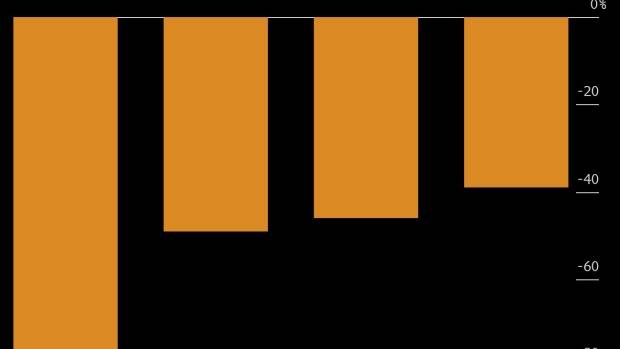

The year has already seen three debt-laden countries — Egypt, Pakistan and Lebanon — drop their exchange rates to unlock International Monetary Fund assistance. That may be just the beginning. With at least two dozen nations queuing up before the Fund for rescue packages, currency traders are bracing for a potential fresh wave of devaluations in the developing world.

“Additional devaluations in some of the fragile frontier markets are very likely,” said Brendan McKenna, a strategist at Wells Fargo & Co. in New York. “As external buffers get depleted, their ability to defend pegs diminishes. Investors with exposure to these markets should think about hedging against devaluation risks.”

Slowing economies have left some emerging and frontier markets with unsustainable debt burdens and shortages of dollars.

“Frontier countries compensated for their lack of local savings by borrowing abroad when that was cheap, and have now been hit hard by the repricing of global interest rates,” said Charles Robertson, global chief economist at Renaissance Capital Ltd. in London.

Now, currency pegs and managed exchange rates have come under strain, and distortions in countries including Nigeria and Lebanon have led to the adoption of multiple exchange rates.

While weaker currencies can help attract capital and make a country more competitive in trade terms, it can also bring higher inflation and ballooning debt repayments. That means investors should beware of routs in countries possibly on the brink, according to Hasnain Malik, a strategist at Tellimer in Dubai.

“Currency devaluation makes a number of equity markets in the smaller emerging and frontier universe untouchable,” Malik said, naming Argentina, Egypt, Ghana, Lebanon, Nigeria, Pakistan, Sri Lanka and Zimbabwe.

When China unexpectedly devalued the yuan in August 2015, it led to a global selloff, erasing $13 trillion from equity-market capitalization in six months. Any such reverberations are unlikely this time around, with smaller markets facing pressure to push their currencies significantly weaker.

Here’s a look at some of the nations that investors see most at risk:

Argentina

Argentina has been trying to stave off a sudden devaluation, unveiling rules on who can access dollars and how that have given rise to a dozen overlapping exchange rates. The official rate is 190 pesos, but a dollar costs 373 on the streets of Buenos Aires. The IMF, which has committed $44 billion in financing, has called for the unwinding of the restrictions. Asked about the possibility of devaluation, a central bank spokesman referred to the government’s 2023 budget, which indicates the peso will end the year significantly weaker than the official rate, at 269 pesos per dollar, yet still a long way from the black-market rate.

Nigeria

Africa’s largest economy is widely expected to devalue the naira after elections later this month, with the median estimate compiled by Bloomberg calling for it to fall by a fifth.

“The risk in Nigeria of a currency devaluation is high,” said Ayodeji Dawodu, head of Africa sovereign and credit research at Banctrust Investment Bank Ltd in London. “It is very evident in the differential between the official rate and the black-market rate.”

The currency trades at about 755 per dollar in the informal market, while the official rate is about 460. Like Argentina, Nigeria operates multiple exchange rates for different transactions. All three leading presidential candidates have pledged to end that. A central bank spokesman didn’t respond to a call and text message on the subject.

Malawi

Malawi devalued the kwacha by 25% in May to address a shortage of foreign exchange. While the spread between the official rate and market rate narrowed initially, it widened once again from September, and the currency weakened to a record on Feb. 8, after the central bank said in January it would conduct periodic dollar sales. The central bank didn’t immediately reply to a request for comment.

Ethiopia

Ethiopia has been pushing back against speculation that it may devalue its currency and has cracked down on the unofficial market. The birr trades at about 99 per dollar, compared with the official rate of 53.5. The East African nation began seeking a deal in 2021 with the IMF, and the lender said in January it’s seeking a “constructive and meaningful” engagement with Ethiopia’s government. Progress on debt relief has been hampered by two years of civil war. The central bank didn’t immediately reply to a request for comment.

Bangladesh

Bangladesh has announced plans to move to a unified exchange exchange rate with a 2% variation by June. But the South Asian nation, which caps its currency at 107 per dollar, may also need a 26% devaluation, according to Bloomberg Economics. To boost exports and curb imports, the taka will need to fall to 145, said analyst Ankur Shukla. A central bank spokesman said he sees no need to devalue.