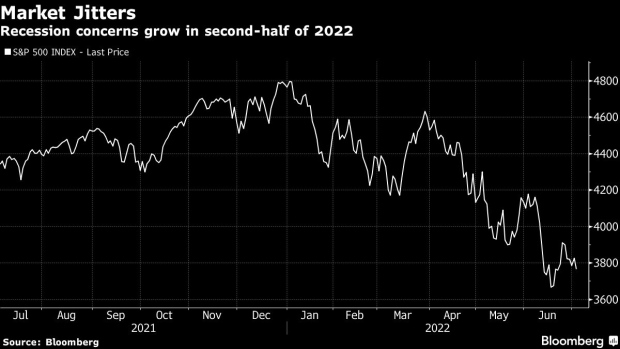

New York July 6 2022: As US equities start the week coming off their worst first half since 1970, there’s only one way of describing how they are moving, according to Neil Dutta.

“This is a recession trade,” the head of economics at Renaissance Macro Research said. “There is no other way of describing it.”

Adding to his list of reasons are Treasury yields declining, oil prices slipping, corporate-credit spreads widening and the dollar climbing.

The S&P 500 dropped as much as 2.2% on the first trading day of a shortened week amid a flight away from risky assets. Treasury yields retreated, with the 10-year yield around 2.8%. Meanwhile, the dollar climbed, which makes commodities priced in the currency less attractive. Oil sank, trading under $100 a barrel.

To be clear, Dutta does not think the US economy is currently in a recession.

“We’re not in one right now, but the markets are a discounting mechanism and I think the markets see the economy potentially going into one or getting closer to being one,” said Dutta, an economy-watcher widely followed in financial markets. “We’ve gone some way into pricing in a recession in the markets, but I don’t think we’re all the way there.”

His stance is a turnaround from an earlier call, when he said he did not see a recession in the cards. Now, he is less confident in the US economy as inflation accelerated to a fresh four-decade high, prompting the Federal Reserve to raise its policy rate by 75 basis points, the most since 1994.

“I don’t think one is inevitable but I think that a lot of it is dependent on what the Fed does,” he said, referring to the odds of a recession. “If the data suggests that the Fed should pivot from its current policy approach and they don’t, then we have a problem. To me that that’s the issue.”

The Fed has “locked themselves” into an aggressive tightening path, perhaps in a bid to avoid the mistake officials made during the start of the pandemic, when they labeled inflation as “transitory,” he said. But what if inflation has already peaked? Dutta thinks the headline print in July will moderate “quite substantially” as prices of oil come down.

Still, if a recession does come, expect one thing, he said: market volatility. Predicting one however is not as clear cut, as many market watchers can agree to.

“A recession call cannot be made if the labor market is not participating,” Dutta added. “The US economy continues to add jobs. So, there is no way the recession (if it comes) will be dated to June 2022.”

With fears of a recession in focus, investors will get a fresh update on the US labor market on Friday. The monthly payrolls report is expected to show a gain of 250,000 jobs for June, while the unemployment rate is seen holding at 3.6%.