Istanbul November 24 2022: Turkey’s central bank said it’s ending its monetary easing cycle after bowing to a call by President Recep Tayyip Erdogan to take interest rates into single digits by the end of the year.

The Monetary Policy Committee led by Governor Sahap Kavcioglu on Thursday lowered the benchmark to 9% from 10.5%, matching the forecasts of all analysts surveyed by Bloomberg. The lira was little changed after the decision, trading 0.1% lower at 18.6309 per dollar as of 2:08 p.m. in Istanbul.

The MPC said in a statement that “the current policy rate is adequate and decided to end the rate-cut cycle that started in August.”

The fourth straight cut underscores Turkey’s extreme outlier status during a year that’s seen the world’s most aggressive and synchronized monetary policy tightening in 40 years in response to inflation shocks.

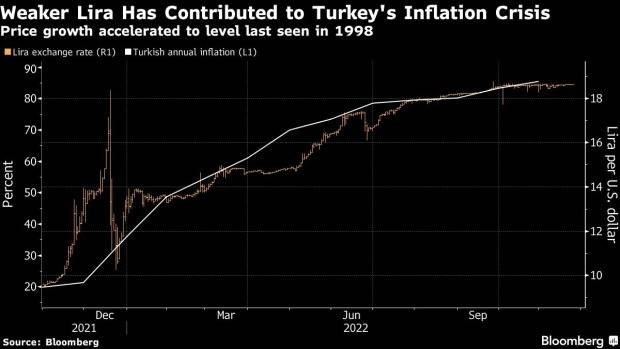

Turkey has done the opposite, guided by Erdogan’s unconventional belief that lower rates have the power to cool inflation. Before the latest decision, the central bank had slashed its benchmark by 350 basis points since August despite price growth that’s exceeded 85% and will likely end the year as the second-highest in the Group of 20 after Argentina.

Erdogan has wielded greater power over the central bank since 2018, firing all three of Kavcioglu’s predecessors for taking a line he deemed insufficiently dovish. But his sway became even more evident this year as he pressed for lower rates to turbocharge the economy ahead of elections by promoting cheap loans.

The president hasn’t backed down even with annual inflation now 17 times higher than the official target and the fastest since he took power two decades ago.

The central bank expects price growth to end the year at about 65%, a more upbeat assessment than the view of many economists. Last month, Kavcioglu conceded that “we cannot count ourselves as successful in lowering inflation.”

To spare the economy and the currency further damage, authorities are encouraging targeted lending that tilts the allocation of cheap capital toward exporters and investment-oriented firms.

Without the option to raise rates to support the lira, policy makers have instead been intervening in the currency market and putting pressure on commercial banks to limit purchases of foreign exchange by their clients.

Still, the lira has depreciated almost 29% against the dollar this year, the worst performer in emerging markets after the Argentine peso.

While the costs of the ultra-loose approach are mounting, the central bank boasts gross reserves that have grown to their highest this year and are set to rise further by the end of this month.

The rapid-fire rate cuts since August mirror the central bank’s approach a year ago, when 500 basis points in monetary easing triggered a crash in the currency and touched off inflation. But the stimulus this year will have less of an impact than in 2021, according to Morgan Stanley.

“This is because of the increasing weight of banking sector regulations in the monetary policy framework,” said Morgan Stanley economists including Alina Slyusarchuk. However, they said in a report that “keeping the Turkish lira stable will likely be seen as more costly in terms of loan growth and economic activity as we get closer to the elections.”