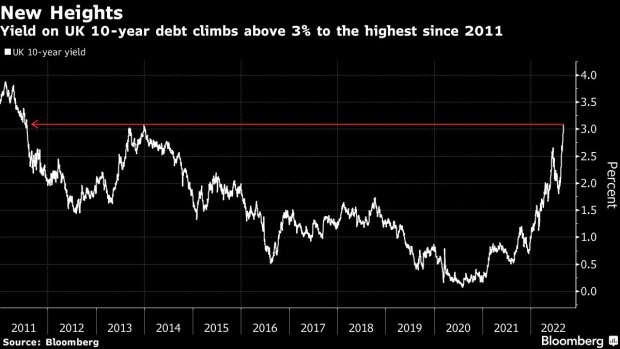

London September 6 2022: The yield on 10-year UK government debt climbed past 3%, soaring to the highest since 2011 on expectations that new Prime Minister Liz Truss will usher in a wave of public spending.

Benchmark borrowing costs rose as much as 20 basis points to 3.14% as of 3:12 p.m. in London, taking their increase to more than 140 basis points since early August. Truss, who won a close Conservative vote, has pledged billions in fiscal support to revitalize the economy. Her plans include a £130 billion freeze on energy bills to avert a crisis over the winter.

Liz Truss’s Relief for Energy Bills Is Uncapped Liability for UK

Swaps linked to the Bank of England’s policy meetings show rate-hike expectations have moved steadily higher since early August, implying the key rate will more than double from 1.75% before year-end. There are fears that inflation, which came in at 10.1% for July, will spiral further out of control, even after six back-to-back rate hikes by policy makers.

Officials couldn’t be complacent at a time when an upward drift in inflation expectations are becoming apparent, BOE policy maker Catherine Mann, said in a speech Monday.

Markets Scream Warning Over New UK Prime Minister’s Mammoth Task

Expectations that Truss would ramp up public borrowing to boost the UK’s flailing economy have also been a factor in driving gilt yields higher. Writing in the Financial Times on Monday, Kwasi Kwarteng, who is expected to become her Chancellor of the Exchequer, insisted that her government would act in “a fiscally responsible way.”

The yield gap between short-maturity notes and longer bonds increased by the most since March 2020. That suggests that while traders see the planned curbs on energy costs contributing to slower inflation in the short term, there will need to be more borrowing down the line to foot the bill — driving up the rate on notes that come due later.