New York October 18 2022: The world’s biggest banks are heading for their worst year of credit trading in a decade as soaring interest rates and global economic uncertainty bite into their profits.

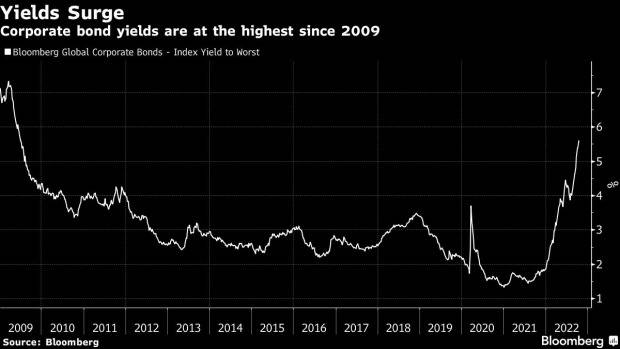

The 200 biggest investment banks are set to collectively make $8.3 billion this financial year, a 36% yearly drop and the lowest since at least 2012, according to forecasts from Coalition Greenwich. Company bond yields are at the highest levels since the financial crisis in 2009.

“This year feels especially challenging in light of the excellent revenue environment we saw in 2020 and 2021,” Mollie Devine, research director at Coalition Greenwich, said in an interview. “When revenue pools contract we tend to see banks think more critically about personnel needs. On the margins, desks start to become more cautious on new hires and to look at existing traders more carefully.”

Credit trading refers to buying and selling instruments such as government and corporate bonds across global debt markets — one of the key arenas for firms to raise financing. If a borrower opts to raise debt on the public markets, it will typically hire a syndicate of banks to work together and find investors to buy those bonds in what is historically a big source of revenue for global lenders.

Last year’s top three arrangers of global corporate bond deals, JPMorgan Chase & Co., Bank of America Securities and Citigroup Inc., have maintained their positions so far this year but seen volume roughly halve. JPMorgan has arranged $78 billion of offerings year-to-date compared with $144 billion at the same point in 2021, while Bank of America is credited with $67 billion versus $126 billion last year. Citi’s $64 billion share is down from $118 billion.

Representatives for the banks declined to comment.

“Flows which drive revenues have been very low as the huge volatility and corresponding low liquidity in turn lowers volumes,” said Max Castle, a fixed income portfolio manager at Mediolanum. “Many investors are more likely to sit on existing cash bond positions rather than make big changes due to the liquidity challenges and instead use derivatives to alter the risk profile of portfolios.”

JPMorgan has helped bring bond deals to market for the likes of Amazon Inc. and also worked on a $30 billion, 11-part transaction for AT&T Inc. and Discovery Inc. in March, Bloomberg’s league table data show. Bank of America and Citi have helped arrange deals for firms including Meta Platforms Inc. and Caterpillar Inc. respectively.

Yet overall volumes have slumped as firms take a cautious approach to raising debt. Global non-financial corporate bond issuance has dropped nearly 35% on last year to $1.5 trillion and the lowest level since 2012, according to Bloomberg league table data.

Borrowers have had to contend with ever-narrower windows in which to get deals done, opting to avoid days with important data releases, central bank meetings or national holidays in other countries to maximize the available investors.

The subsequent lack of new issuance has hurt lenders’ revenues, and investors are sitting on the sidelines given macro-economic uncertainty, Coalition’s Devine said.

Firms’ clients have been more reluctant to trade, with many waiting until rates have settled at a higher point. “However by the end of last year spreads had gotten very tight, and this year there was almost nowhere to go but up,” she said.

Elsewhere in credit markets:

EMEA

There were 11 issuers raising at least €6.56 billion-equivalent in Europe’s primary market on Tuesday. Morgan Stanley is jumping into the European bond market, seeking at least €1 billion across a two-part deal on Tuesday in six-year and 11-year fixed-to-floating rate notes, according to a person familiar with the matter.

Italian football club AS Roma SpA is repaying its bond investors early and in full as it seeks to lock in new debt.

German power company EnBW Energie Baden-Wuerttemberg AG is looking to sidestep the volatility of public debt markets to raise the equivalent of $1 billion privately, according to people familiar with the matter

The screws are turning on companies that need to make refinancing decisions for more than $50 billion of junior bonds, with some taking unusual steps as the cost of issuing new debt soars

The stress weighing on credit markets is proving a boon for Ture Invest AB, a Swedish private lender that is increasingly filling the void left by derisking banks and bond markets

The recent tumult in the UK government bond market is likely to be repeated where leveraged strategies are in place, said BlackRock Financial Management Inc.’s Bob Miller

The Bank of England denied a Financial Times report saying the central bank is delaying the start of its program of gilt sales

Asia

Chinese junk dollar bonds dropped to a record low on Tuesday, as a property debt crisis sparked by a crackdown on excessive borrowing and a slide in home sales showed few signs of turning around.

Dollar bonds from some Indonesian property developers are also heading for their biggest declines in roughly seven weeks as concerns about refinancing spreads across the sector

Elsewhere, Australia’s policy rate trajectory has been steeper than most other countries despite the central bank’s unexpectedly smaller quarter-point hike this month, said Reserve Bank No. 2 Michele Bullock

Americas

T-Mobile US Inc. has boosted the size of its revolving credit facility to $7.5 billion and removed certain collateral pledges, as the borrower looks to take advantage of its recently achieved investment-grade rating.

Bank of Nova Scotia, the Canadian bank with the largest exposure to Latin America, sold $750 million of loss-absorbing hybrid securities amid mounting concerns about the spillover effects of US Federal Reserve rate hikes on emerging-market economies

Mark Mobius warned that interest rates will soar to a three-decade high of 9% if inflation persists