New York September 16 2024: When the Federal Reserve delivers a widely-anticipated interest rate cut on Wednesday, its first in four years, the move will resonate well beyond the United States.

The size of a first move and the scale of overall easing remains open to debate, while a looming U.S. election is another complicating factor for global investors and ratesetters looking for a steer from the Fed and pinning hopes on an economic soft landing.

“We don’t know yet what kind of cycle this is going to be – will it be like 1995 when there was just 75 bps of cuts or 2007-2008, when there was 500 bps,” said Kenneth Broux, head of corporate research, FX and Rates at Societe Generale.

Here’s a look at what is in focus for world markets:

1/ FOLLOW THE LEADER

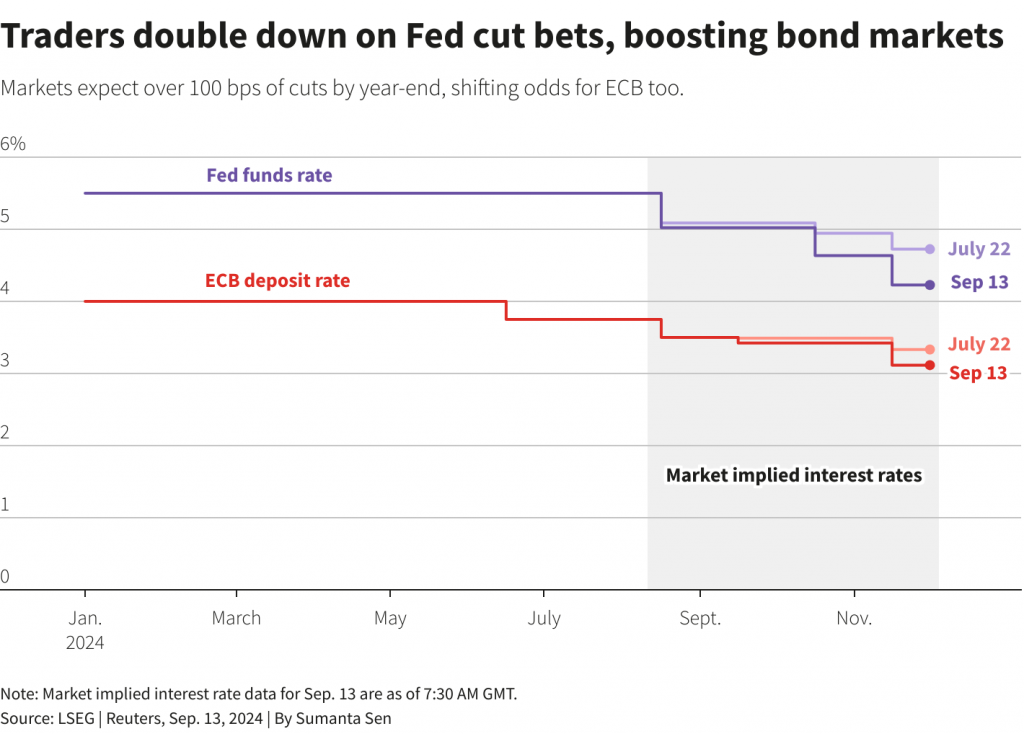

In spring, as U.S. inflation proved stickier than expected, investors questioned how far others such as the European Central Bank or the Bank of Canada could cut rates if the Fed stayed on hold this year before their currencies weakened too far, adding to price pressures.

U.S. cuts finally starting comforts regions facing weaker economies than the United States.

Traders added to bets for rate reductions by other central banks as Fed rate-cut expectations grew recently.

Yet they price fewer cuts in Europe than for the Fed, with the ECB and Bank of England sounding more vigilant around remaining inflation risks.

Confidence in Fed cuts starting is a boon for bond markets globally that often move in lock step with Treasuries.

U.S., German and British government bond yields are all set for their first quarterly fall since end-2023, when a Fed pivot was anticipated.

2/ BREATHING SPACE

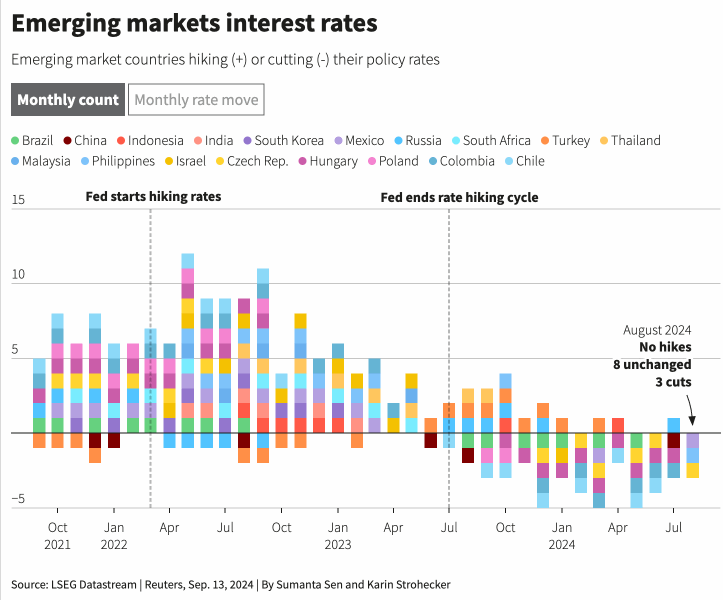

Lower U.S. rates could give emerging market central banks more room for manoeuvre to ease themselves and support domestic growth.

Around half of the sample of 18 emerging markets tracked by Reuters have already started cutting rates in this cycle, front-running the Fed, with easing efforts concentrated in Latin America and emerging Europe.

But volatility and uncertainty around the U.S. Presidential election clouds the outlook.

“The U.S. election will have a major bearing on this because, depending on various fiscal policies, it really complicates the cutting cycle,” said Trang Nguyen, global head of EM credit strategy at BNP Paribas. “We could see more idiosyncratic actions among central banks on the back of that.”

3/ STRONG DOLLAR REPRIEVE?

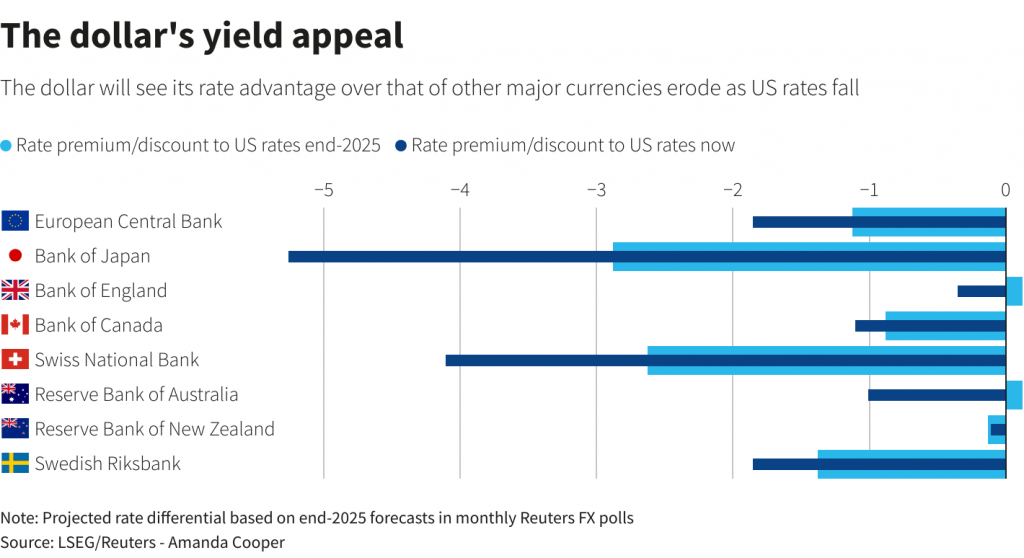

Those economies hoping U.S. rate cuts will weaken the robust dollar further, lifting their currencies, may be disappointed.

JPMorgan notes the dollar has strengthened after a first Fed cut in three out of the last four cycles.

The dollar outlook will be driven largely by where U.S. rates are relative to others.

The safe-haven yen and Swiss franc could see their respective discounts to U.S. rates almost halve by end-2025, Reuters polls suggest, while sterling and the Australian dollar may only acquire a marginal yield advantage over the dollar.

Unless the dollar becomes a real low-yielder, it will continue to hold its appeal among non-U.S. investors.

Asian economies, meanwhile, have led markets’ front-running of U.S. cuts, with South Korea’s won, the Thai baht and Malaysian ringgit surging through July and August. China’s yuan has wiped out year-to-date losses versus the greenback.

4/ RALLY ON

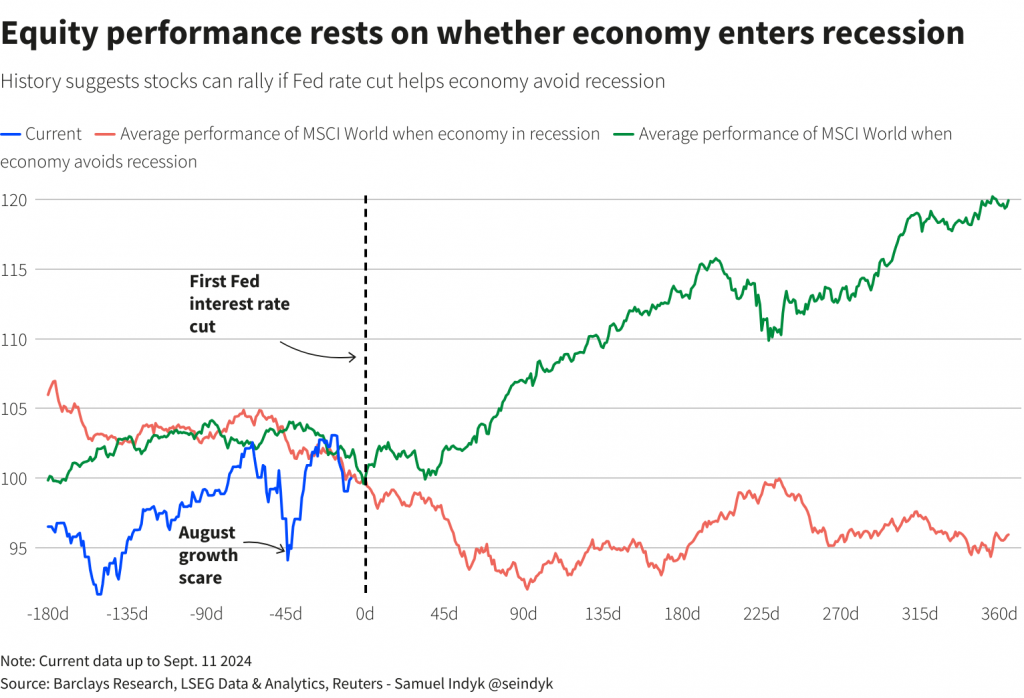

A global equity rally, which faltered recently on growth fears, could resume if lower U.S. rates boost economic activity and means recession is avoided.

World stocks tumbled more than 6% in three days in early August following weak U.S. jobs data.

“You always have a wobbly market around the first cut because the market wonders why central banks are cutting,” said Barclays head of European equity strategy Emmanuel Cau.

“If you have a cut without a recession, which is the mid-cycle script, usually the markets tend to go back up,” Cau said, adding that the bank favoured sectors benefiting from lower rates, such as real estate and utilities.

A U.S. soft landing should also play well in Asia, although the Nikkei has fallen more than 10% from July’s record high on a rising yen and as Japan’s rates rise.

5/ TIME TO SHINE

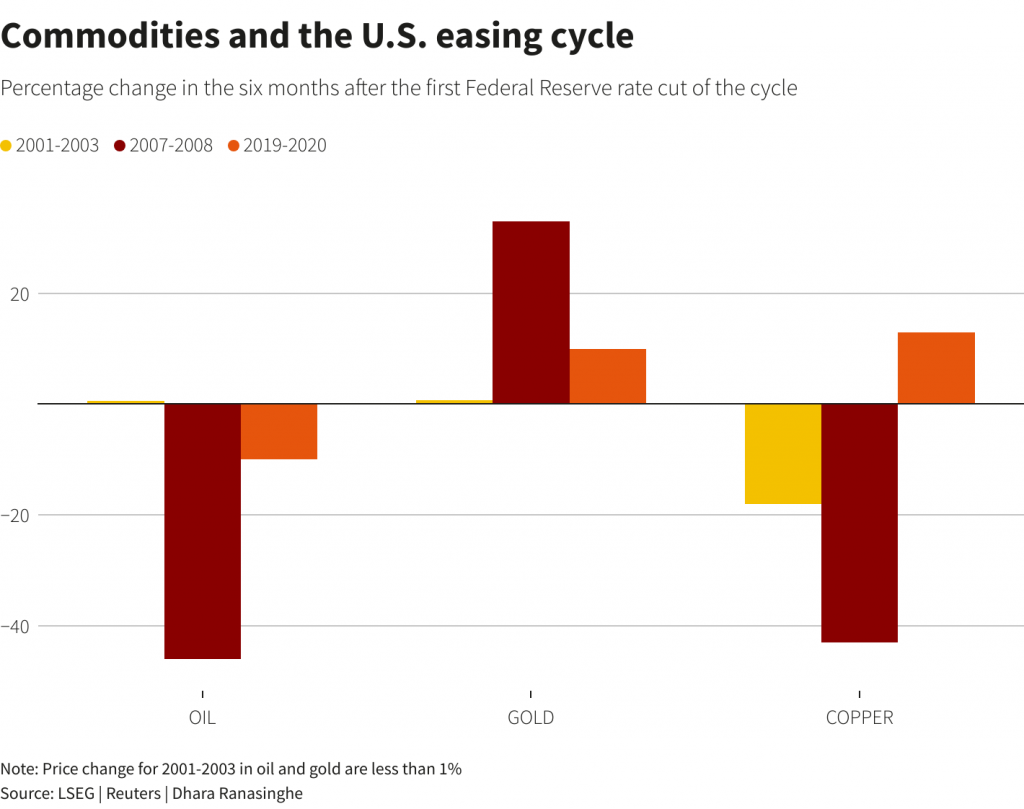

In commodities, precious and base metals such as copper should benefit from Fed rate cuts, and for the latter the demand outlook and a soft landing are key.

Lower rates and a weaker dollar, reducing not just the opportunity cost of holding metals but also of buying them for those using other currencies, could fuel momentum.

“High rates have been a critical headwind to base metals, driving a significant negative physical demand distortion from destocking and weighing on capital intensive end-demand segments,” said MUFG’s Ehsan Khoman.

Precious metals could also gain. Gold, which typically has a negative relationship with yields as most demand is for investment purposes, usually outperforms other metals during rate cuts. It is at record highs, but investors should be cautious, said the World Gold Council’s John Reade.

“Speculators on the Comex gold futures markets are positioned for this,” said market strategist Reade. “It could be a case of buying the rumour and selling the fact.”