London November 14 2022: Problems are multiplying for the world’s biggest crypto fund as chaos engulfs the industry in the wake of exchange FTX’s shock bankruptcy filing.

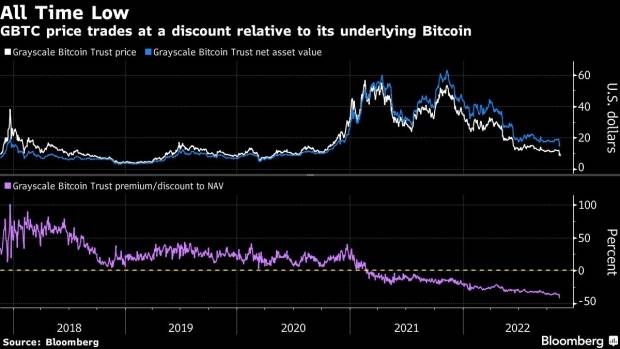

The $11.4 billion Grayscale Bitcoin Trust (ticker GBTC) has plunged more than 74% this year, outpacing the cryptocurrency’s 64% decline. That gap has widened dramatically over the past week, dragging the price of GBTC to an unprecedented 42% discount to the value of the Bitcoin it holds, according to Bloomberg data.

The dislocation is rooted in the fact that despite Grayscale’s best efforts, US regulators have repeatedly denied applications to convert GBTC into a physically-backed exchange-traded fund — a structure that the Securities and Exchange Commission has yet to approve, despite allowing the futures-backed ProShares Bitcoin Strategy ETF (BITO) to launch a year ago. In its structure as a trust, GBTC isn’t able to redeem shares to keep pace with shifting demand, exacerbating its net-asset value discount while the derivatives-backed ETFs stay in lockstep with theirs.

“We have a broken product in GBTC that the SEC allows any retail investor to get their hands on,” said Nate Geraci, president of advisory firm The ETF Store. “BITO sticking to its NAV is yet another demonstration of the superiority of the ETF structure and adds to the growing list of reasons why a spot Bitcoin ETF should exist.”

BITO has dropped 65% so far in 2022, similar to Bitcoin’s slide. Though fears about BITO’s roll costs — the expense of having to continually roll forward futures contracts as they expire — produced much hand-wringing before its debut about the fund’s potential tracking error, those concerns have been largely unfounded.

Meanwhile, GBTC’s discount is one of the primary reason why Grayscale has pushed for the trust’s conversion into an ETF. The SEC’s denial in June led the firm to sue the agency.

The contrast between GBTC’s record discount and BITO’s tight tracking should bolster the case for spot Bitcoin ETF approval, but “the likelihood has dwindled further due to FTX’s struggles,” in the eyes of Bloomberg Intelligence.

“As far as GBTC goes, I don’t know what stops this thing from sinking into a further discount,” said Bloomberg Intelligence ETF analyst James Seyffart. “There’s also an argument to be made that the widening discount is reflective of a lower probability or at last a longer time frame before GBTC is able to convert to an ETF.”